MyDebit Overview

Introduction

MyDebit Scheme is a payment application that enables Cardholders to use their ATM card to pay directly from their bank account via a POS terminal and a dual-interface which supports both contact, contactless transaction and card-not-present transaction.

The parties involved in the MyDebit scheme are:

- PayNet: Provides the central switching, clearing and settlement functions for all MyDebit transactions.

- Issuer: Validates the authorisation on the debit request to MyDebit System as well as processing the debit request to Cardholders account.

- Acquirer Bank: Financial Institution authorised by PayNet or Bank Negara Malaysia to recruit merchants and to deploy MyDebit terminals to support MyDebit Scheme.

- TPA: A Non-Financial Institution authorised by PayNet or Bank Negara Malaysia to recruit merchants and to deploy MyDebit terminals to support MyDebit Scheme.

- Merchant: A business, Government Agency, or organization that offers goods and/or services and accepts MyDebit as one of the mode of payments at the counter.

- Cardholder: A person who holds MyDebit card issued by an Issuer that maintains the accounts (i.e. Savings / Current) that could be accessed by such card.

Check out the glossary which provides definitions and explanations of frequently used terms for MyDebit Secure. You may also refer to Abbreviations which been used in this document.

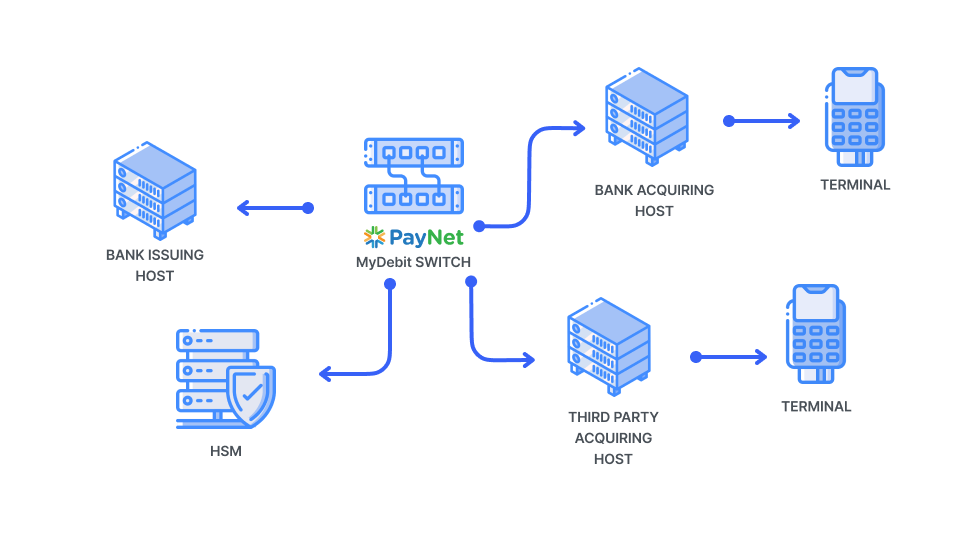

MyDebit System Overview between PayNet and Participants

- The Terminals are connected to the Acquiring host which will route all transactions to MyDebit Switch. These transactions are then sent to the Issuer host for authorisation process.

- The Issuer will acknowledge the transaction by sending a response to MyDebit Switch with an approval or decline response code.

- The MyDebit Switch will then forward the transaction to the Acquirer with the same response code. The Acquirer will then deliver the response to the Terminals to complete the transaction.

MyDebit Switch Connection

- Connection to MyDebit Switch is limited to the Participants of the MyDebit Scheme only.

Type of Transactions

The MyDebit System shall only support real-time online transactions. Offline transactions as well as Stand-in mode processing is not supported by MyDebit System. The supported transactions are:

Purchase

A financial transaction consisting of payment information of goods or services purchased/rendered initiated by the Cardholders. The transaction is captured and submitted to the Issuer for payment authorisation.

Process Flow for Purchase:

The transaction message flow below explains the summarised overview of the message transfer between the Acquirer, MyDebit Switch and the Issuer for a Normal Purchase.

| Steps | Description |

|---|---|

| 1 | The Acquirer sends a ISO8583 0200 external message to MyDebit Switch. |

| 2 | MyDebit Switch then forwards the ISO8583 0200 purchase request message to the Issuer for authorisation. |

| 3 | Issuer authorises the transaction and sends a ISO8583 0210 response message to MyDebit Switch |

| 4 | MyDebit Switch then forwards the ISO8583 0210 response message to the Acquirer to be completed. |

Purchase Cancellation

A Purchase Cancellation is a financial transaction initiated by a Merchant or an Acquirer to cancel an approved purchase transaction and process a refund to the Cardholder. The transaction must be submitted by the Merchant or service provider within the same day of the purchase transaction intended to be cancelled.

Process Flow for Purchase Cancellation:

| Steps | Description |

|---|---|

| 1 | The Acquirer sends a ISO8583 0200 purchase cancellation request message to MyDebit System. |

| 2 | MyDebit Switch then forwards a ISO8583 0200 purchase cancellation message to the Issuer. |

| 3 | Issuer acknowledges the transaction and sends a ISO8583 0210 purchase cancellation response message to MyDebit Switch. |

| 4 | MyDebit Switch then sends the ISO8583 0210 purchase cancellation response message to the Acquirer. |

Purchase with Cash Out

A financial transaction consisting of payment of goods or services, and cash withdrawals in the same transaction.

For Purchase with Cash Out, the transaction amount is divided into two categories, the purchase amount and the Cash Out amount. The purchase activity remains the same as the normal Purchase transaction.

Authorisation Request (0200) will be sent to the Issuer host via MyDebit Switch. The message will contain additional field for Cash Out amount.

The Issuer bank verifies the request and deducts Cardholder’s account for MyDebit, Cash Out withdrawal and replies with the Authorisation Response (0210) message.

For Purchase with Cash Out, the Cash Out amount must not be more than RM500 per transaction.

Process Flow for Purchase with Cash Out:

| Steps | Description |

|---|---|

| 1 | The Acquirer sends a ISO8583 0200 purchase with cash out request message to MyDebit Switch. |

| 2 | MyDebit Switch then forwards an request message to the Issuer for Cash Out authorisation. |

| 3 | The Issuer then authorizes the Cash Out and sends a 0210 response external message to MyDebit Switch. |

| 4 | MyDebit Switch then forwards the 0210 response message to the Acquirer to complete the Cash Out transaction. |

Purchase with Cash Out Cancellation

The purchase activity remains the same as the normal Purchase Cancellation transaction. Refer to Process Flow for Purchase Cancellation as mentioned earlier.

Cashier will initiate the void function on the terminal and key in the invoice number.

Process Flow for Purchase with Cash Out Cancellation:

| Steps | Description |

|---|---|

| 1 | The Acquirer sends a ISO8583 0200 purchase with cash out cancellation request message to MyDebit Switch. |

| 2 | MyDebit Switch then forwards ISO8583 0200 request message to the Issuer. |

| 3 | Issuer acknowledges the transaction and sends a ISO8583 0210 purchase with cash out cancellation response message to MyDebit Switch. |

| 4 | MyDebit Switch then forwards a ISO8583 0210 purchase with cash out cancellation response message to the Acquirer. |

Pre-Authorisation

A pre-authorisation entails earmarking an amount of funds in a Cardholder’s bank account pending completion of a MyDebit transaction where the actual transaction amount cannot be determined at point of purchase initiation. The earmarked funds cannot be used and the earmark will only be removed after the transaction is completed or when the earmark period has expired.

A pre-authorisation is typically used to facilitate transactions using OPT at self-service petrol pumps or expressway or parking or hotel.

Process Flow for Pre-Authorisation:

a. For pre-authorisation involving transactions at OPT, the Issuer has to release the earmarked funds and debit the actual transaction amount after the sales-completion message is received from the Acquirer

b. In the event the Issuer does not receive the sale-completion message from the Acquirer, the Issuer shall hold the earmarked funds in accordance to the revised Debit Card and Debit Card-i policy document issued by BNM on 2 December 2016.

c. For pre-authorisation arising from transactions at OPT, the pre-set or configurable amount shall be at a minimum of RM0.01

d. An Acquirer shall ensure that the pre-set amount menu or button at OPT is enabled and ensure clear instructions is given to the Cardholder to enter the required pre-authorisation amount.

e. An Acquirer shall ensure that the final sales-completion is immediately send to Issuer as soon as the fuel nozzle is placed back on the pump. In exceptional cases, if the Issuer did not receive the sales-completion amount immediately, Issuer shall earmark the funds for no more than three (3) Calendar Days (T+2). Any discrepancies which arises from the Acquirer’s delay in responding will be treated as a dispute and will be handled via the MyDebit ECMS. The Acquirer shall be responsible to pay for the disputed amount

f. An Acquirer shall ensure that the sales-completion released to the Issuer shall not exceed the pre-authorisation amount selected by the Cardholder. Otherwise, the Acquirer will be responsible to pay for the disputed amount

g. The Pre-Authorisation service is as set out in the Overlay Service Procedures for MyDebit Pre-Authorisation Service effective on 1st April 2021.

h. Participants are required to support MyDebit Pre-Authorisation at Other Segments as an Issuer no later than 1 April 2022 by fulfilling the requirements for MyDebit Pre-Authorisation acceptance at other market segments.

Card-Not-Present (CNP)

- The Card-Not-Present is a service that enables cardholders to perform an online payment transaction when the cardholder is not physically present at the merchant.

- The Card-Not-Present service is as set out in the Overlay Service Procedures for MyDebit Secure (Card-Not-Present) service.

PayNet Tokenisation

- PayNet Tokenisation is a service that enables a central standardised process of replacing the 16-digit MyDebit card number with an encrypted Token that can only be used at the identified online Merchant. This Token can then be stored at the Merchant for a more frictionless customer experience without the normal risks of storing the card number as utility of the Token is restricted.

- The PayNet Tokenisation service is as set out in the Overlay Service Procedures for PayNet Tokenisation service.