Biller Notification System (BNS)

API reference

Introduction

PayNet is facilitating an industry wide initiative to implement ubiquitous online bill payments for Malaysia, called the National Bill Payment Scheme (NBPS). Its fundamental purpose is to facilitate Customers to make online payment of ANY Bill at ANY IBG Bank in Malaysia.

Within NBPS, Billers can opt to receive notification (real-time or batch) when a Customer makes a NBPS bill payment – this is useful for those Billers that provide services which may be cut-off or suspended if payment is not made and where they need to know promptly when a Customer has made a payment.

This document provides the technical specifications for how Billers interface with the Biller Notification System (BNS) of NBPS to receive notifications (real-time or batch) when a Customer has made a payment, which allows the Biller to update their Customer’s account to record the bill payment.

NBPS Overview

PayNet is facilitating an industry wide initiative to implement ubiquitous online bill payments for Malaysia, called the National Bill Payment Scheme (NBPS). Its fundamental purpose is to facilitate Customers to make online payment of ANY Bill at ANY IBG Bank in Malaysia.

While this initiative is primarily targeted for online bill payments (deployment at Internet and Mobile Banking is mandatory), Banks can optionally extend this bill payment mechanism to other channels, including ATMs and Branches.

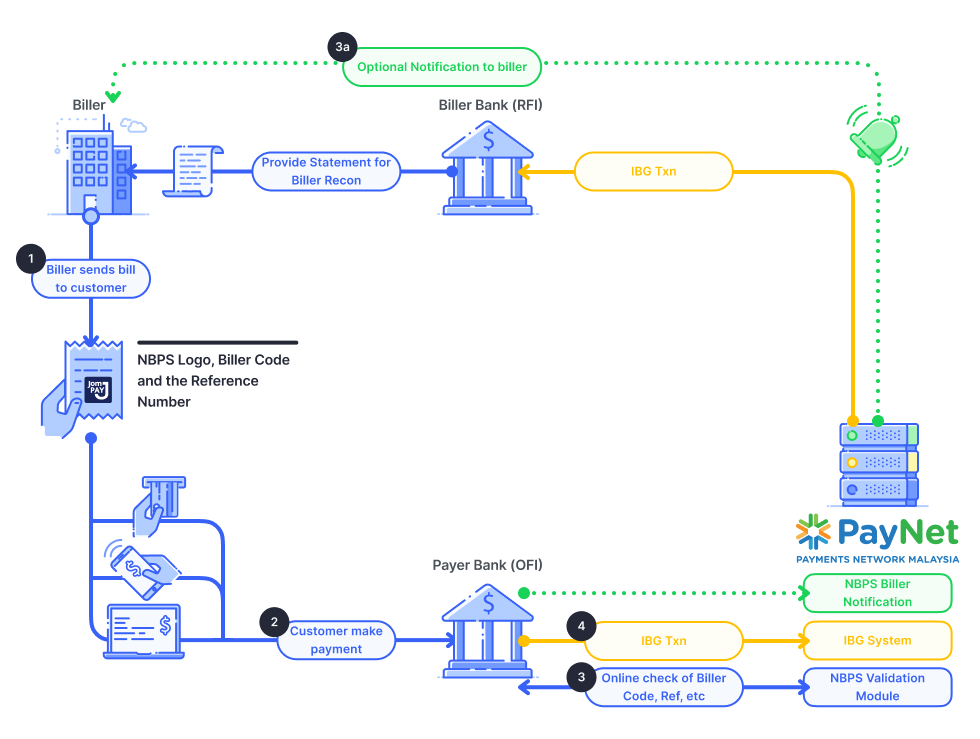

The first phase of NPBS focuses on Open Bill Payments using National Biller Codes and the following diagram depicts the high level functional flow.

Billers register their details on the NBPS system (provided and hosted at PayNet) and the Billers are allocated a unique Biller Code (this is part of the NBPS Biller Management Module which is described separately and is not part of the scope of this document).

Billers send Bills to their Customers in the normal way; however, the Bill now includes the prominent display of the NBPS Logo, Biller Code and the Reference Number. The Reference Number is a unique code that identifies the customer or particular bill to the Biller – it will typically be the existing customer code or invoice number used by the Biller and will include a check digit. Along with the primary Reference Number, the Biller may optionally include a second Reference field.

The Customer will access one of the available payment channels of their Bank, which supports NBPS Bill Payments to make payment (Internet and Mobile Banking is mandatory). On the appropriate online page (which must display the NBPS Logo), the Customer will select the Account to make payment from, enter the Biller Code and Reference Number (and second Reference field if available) from the Bill, and the Amount.

The Bank will then make an online web-services call to the NBPS system (hosted at PayNet) to validate the bill payment details. The NBPS system will validate various items according to the Biller’s registration details, including the Biller Code, the check digit of the primary Reference Number, payment account type, acceptable transaction limit set by Biller, etc. If one of the validations fails, the NBPS system will return an appropriate error code and message, and the Customer will typically correct the entered fields and resubmit the transaction – which would again be passed to the NBPS system for validation. When the NBPS system responds that the validation is successful, it will include various items, including the Biller’s Name, Bank and Account Number, NBPS Reference Number and whether the Biller has opted for online Notification of successful payment. A confirmation page will then be displayed to the Customer, which will include the information entered by the Customer, the Biller Code Name and information related to the primary Reference Number. Upon confirmation by the Customer, the Bank will then proceed to debit the Customer’s account and if successful will proceed with the following.

- If the Biller opted for online notification of successful payment (this is indicated in the response message from the validation call above), the Bank will make an online web-services call to the NBPS system to notify the successful completion of the bill payment transaction. Independently, the NBPS system is responsible to deliver this notification to the Biller (which is described in this document).

The Bank will then credit the Biller’s account – if the returned Biller’s Bank is the same as the Bank from which the Customer is making payment, then the Bank will handle the crediting of funds to the Biller’s account, otherwise, the Bank will use the IBG system to credit the payment to the Biller’s Bank and Account.

The Biller’s Bank is responsible to provide appropriate payment information to the Biller for subsequent reconciliation, which will include certain NBPS specific information.

Biller Notification System (BNS) Overview

Biller Notifications are a form of electronic message sent to the Biller via BNS once the Payer has successfully completed a bill payment transaction at their Bank. NBPS will facilitate the sending of the notification from the Payer’s Bank to the Biller. The notification serves the purpose of informing the Biller that the Payer has successfully completed the bill payment and payment to the Biller will follow.

This flow is applicable to both intra-bank (where the Biller’s Bank and the Payer’ Bank are the same) and inter-bank (where the Biller’s Bank and the Payer’s Bank are different) transactions to ensure uniformity for the Biller.

The Biller Notification service is optional for the Biller. If a Biller opts for this service:

The Payer Bank will notify PayNet when the Payer has successfully completed a bill payment transaction.

PayNet will notify the Biller (as described in this document).

Biller will also have access to the NBPS Biller Portal to query transaction status (refer Section 3 for more details).

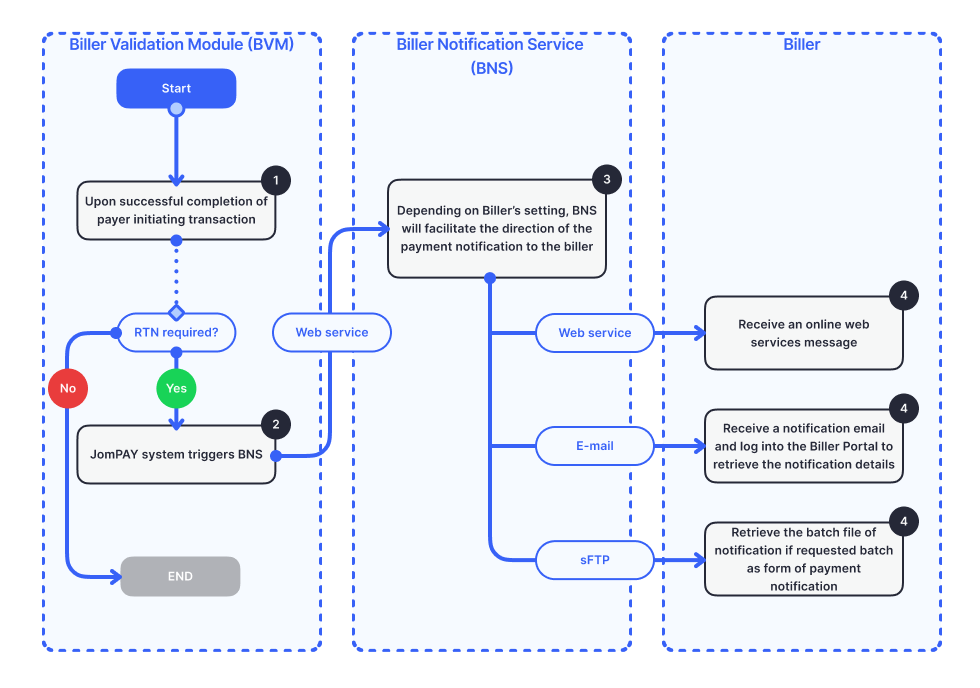

The following table describes the process for Biller Notification.

| STEP | INITIATOR | DESCRIPTION |

|---|---|---|

| 1 | Payer Bank | Once the Payer has been successfully completed the bill payment transaction, the Payer Bank will check if there is a requirement for Biller Notification

|

| 2 | Payer Bank | The Payer Bank will send a Notification message to NBPS to notify that the Payer has successfully completed the bill payment transaction |

| 3 | NBPS BNS | Depending on the Biller’s preference setting, BNS will notify the Biller via one of the following methods:

Details for Biller Notification include:

|

| 4 | Biller | Depending on the Biller’s preference setting, the Biller performs one of the following actions to retrieve Biller Notification messages:

Billers that opt for Biller Notification will also be able to utilise the NBPS Biller Portal to view and retrieve Biller Notification message details |