Overview

A DuitNow Reversal (previously known as credit transfer reversal) is triggered to return funds from a completed transaction to the original payer in the transaction’s original form of payment. This can happen for a multitude of reasons, including customer disputes, suspected fraud or merchant-initiated cancellations (e.g. pre-auth cancellations).

Understanding the Types of Reversals

There are many scenarios a merchant, an acquirer, an issuer or a payer might encounter when it comes to reversing transactions and returning funds, where they can be classified generally under one of the 4 types of reversals: pre-auth cancellation, refund, chargeback or reversal adjustment. DuitNow Reversal supports 2 of the 4 types of credit transfer reversals for all of the DuitNow services that we provide.

Types of Reversals

There are four main types of reversals, but DuitNow Reversal only supports two of them:

A refund is the process of a merchant or recipient returning funds to a payer (or originator) for a transaction that has already been completed (settled). The refunded amount is credited back to the original payment source used by the payer.

Examples of Refunds within DuitNow:- Refunding a DuitNow QR POS transaction by the merchant.

- Refunding a DuitNow Online Banking/Wallet transaction by the merchant.

- Refunding a DuitNow Transfer transaction due to a SAF Rejected status.

- DuitNow Reversal provides two transaction codes for issuing refunds:

- Code 011 - Credit Transfer Reversal (Clear)

- Code 012 - Credit Transfer Reversal (Masked)

- DuitNow Reversal provides a transaction code to initiate refund intent:

- Code 854 - Refund Intent Initiation

Other types of reversals that DuitNow does not support include:

- Chargeback

- Reversal Adjustment

How Refunds and Cancellations work via DuitNow Reversal

As an acquirer, the participant may receive the customer or debtor account number from the transaction that was initiated in clear or encrypted format. Acquirers may directly use the clear or encrypted account numbers to trigger a DuitNow Reversal. On the other hand, acquirers may also separately obtain the clear account numbers

for those encrypted ones in the Transaction Daily Report TAR02 or RPP Daily Itemised Report Coming Soon

The following table shows the DuitNow products and the following types of account number that is provided to the acquirer:

DuitNow Credit Transfer Transaction Codes

| Credit Transfer Transaction Code | Credit Transfer Feature | Reversal Transaction Code | Encrypted or Clear Account Number |

|---|---|---|---|

| 010 | DuitNow Transfer Pay-to-Account | 011 | CLEAR |

| 110 | DuitNow Transfer Pay-by-Proxy | 011 | CLEAR |

| 030 | DuitNow QR MPM POS | 011 | CLEAR |

| 040 | DuitNow QR MPM P2P | 011 | CLEAR |

| 031 Discovery & Future Planning | DuitNow Cross-Border QR MPM POS | 011 | CLEAR |

| 032 Discovery & Future Planning | DuitNow QR Cash Out | 011 | CLEAR |

| 240 Discovery & Future Planning | DuitNow QR CPM | 011 | CLEAR |

| 250 Discovery & Future Planning | DuitNow QR CPM Post-Authorisation | 011 | CLEAR |

| 060 Discovery & Future Planning | DuitNow Request | 012 | ENCRYPTED |

| 070 | DuitNow Online Banking/Wallet | 012 | ENCRYPTED |

| 210 Discovery & Future Planning | DuitNow AutoDebit from Bank | 012 | ENCRYPTED |

| 220 Discovery & Future Planning | DuitNow AutoDebit from Merchant | 012 | ENCRYPTED |

| 210 Discovery & Future Planning | DuitNow AutoDebit Pre-Authorisation | 012 | ENCRYPTED |

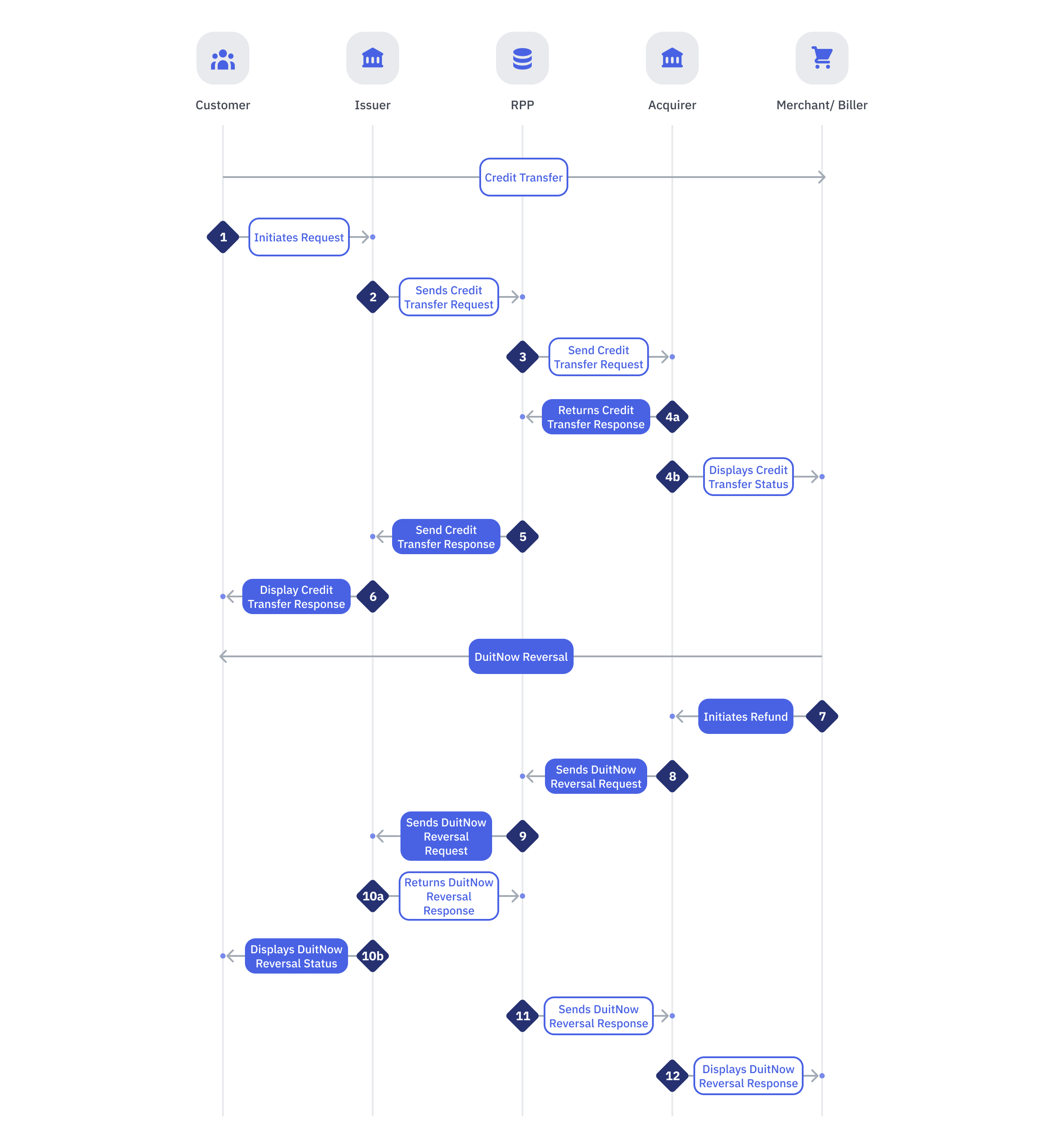

DuitNow Reversal for Refunds

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1-6 | Credit Transfer process as established according to the DuitNow products. | ||

| 7 | Merchant | Acquirer | Merchant confirms result of dispute and initiates refund intent through their Acquirer. |

| 8 | Acquirer | RPP | Acquirer performs the following:

|

| 9 | RPP | Issuer | RPP performs the following:If any of the Message Validations fails:

|

| 10a | Issuer | RPP | Issuer performs the following:If any of the Message Validations fails:

|

| 10b | Issuer | Customer | Issuer informs the Customer on refund status from the Merchant If the Reversal is SUCCESSFUL:

|

| 11 | RPP | Acquirer | RPP Return Response to the Acquirer RPP performs the following:If any of the Message Validations fails:

If the signature received from Issuer could not be verified:

|

| 12 | Acquirer | Merchant | Acquirer updates Merchant on refund status If the Reversal is SUCCESSFUL:

|

RPP Validations on Refund Transactions

RPP does not validate refund request details against the original transaction, including the amount field. As such, Merchants may submit multiple refund requests, whether for the full or partial amount. It is the responsibility of Acquirers to ensure the validity of refund requests and to prevent misuse of the refund feature by their Merchants. Acquirers may implement and enforce their own internal refund policies and requirements as necessary.

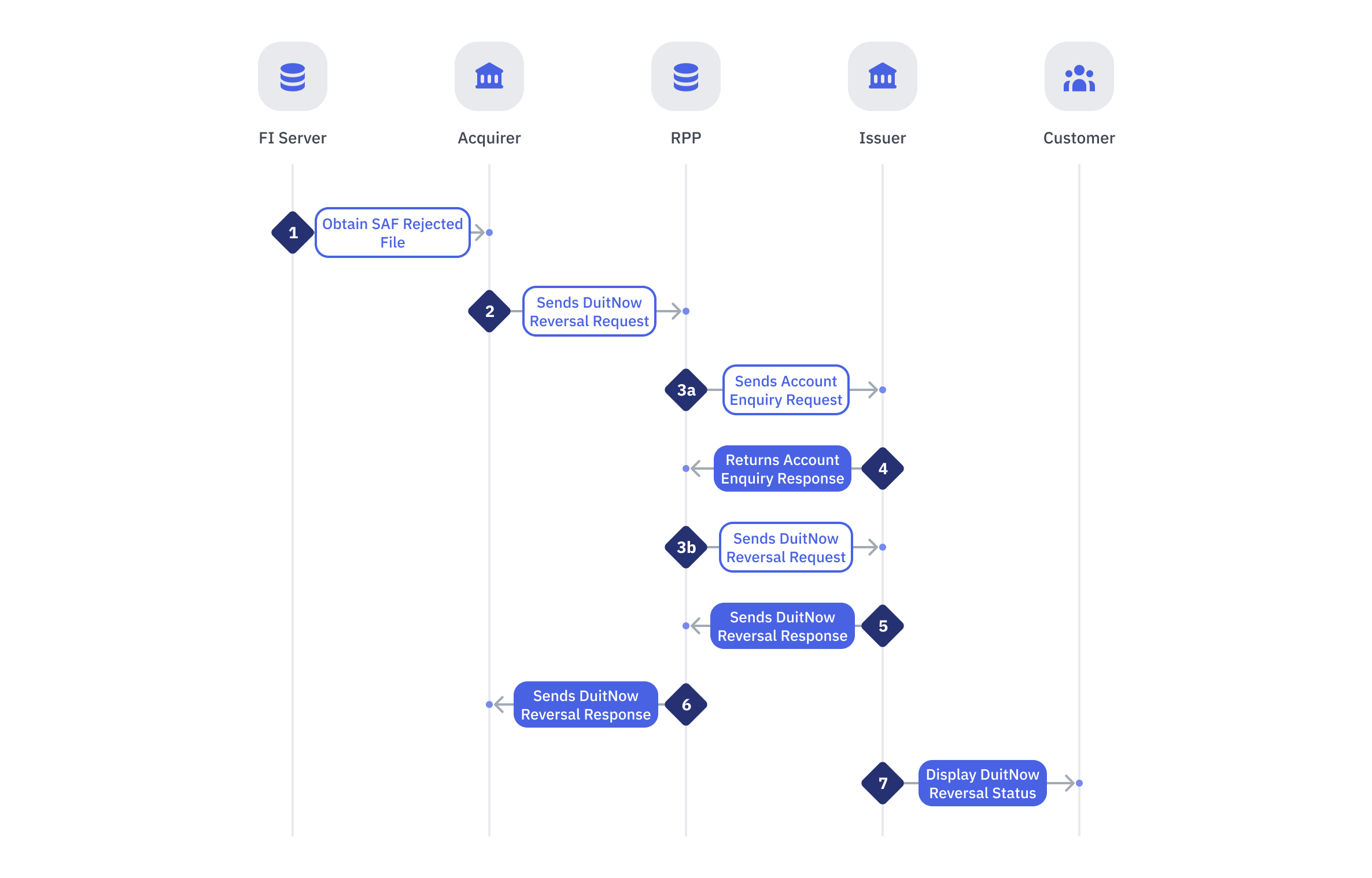

Handling SAF Rejected Transactions

When there’s a timeout at RPP (which can occur if the request wasn’t sent to the acquirer or if RPP didn’t receive a response from the acquirer), the transaction is saved in the Store and Forward (SAF) queue so that it can be sent to the acquirer again for completion. After resending, some transactions will succeed, while others may be rejected or still remain unknown if the timeouts persist and the maximum retry attempts has been reached. At T+1, the rejected transactions will be compiled into the SAF Rejected Transactions Reports (SRTR02 or RTPPR02 depending on the services) for participants to obtain via the FI server. After receiving these files, the acquirer should initiate a DuitNow Reversal transaction for each of the rejected transactions to return the funds back to the issuer.

On the other hand, when transactions encounter timeout issues at the acquirer and remain unknown even after reaching the maximum number of retries, they will be compiled into the SAF Exception Reports (SER02 or RTPPE02), where the issuer and acquirer will need to address them separately from RPP.

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | PayNet | Acquirer | PayNet will provide Acquirer the SAF Rejected Transactions Reports (SRTR02 and RTPPR02) in the FI server where Acquirer can download and view the transactions that were rejected by them. |

| 2 | Acquirer | RPP | Acquirer performs the following:

|

| 3A,3B | RPP | Issuer | RPP performs the following:If any of the Message Validations fails:

|

| 4 | Issuer | RPP | OFI performs the following:If any of the Message Validations fails:

|

| 5 | Issuer | RPP | Issuer performs the following:If any of the Message Validations fails:

|

| 6 | RPP | Acquirer | RPP Return Response to Acquirer RPP performs the following:If any of the Message Validations fails:

If the signature received from Issuer could not be verified:

|

| 7 | Issuer | Customer | Issuer performs the following: If the Reversal is SUCCESSFUL:

|

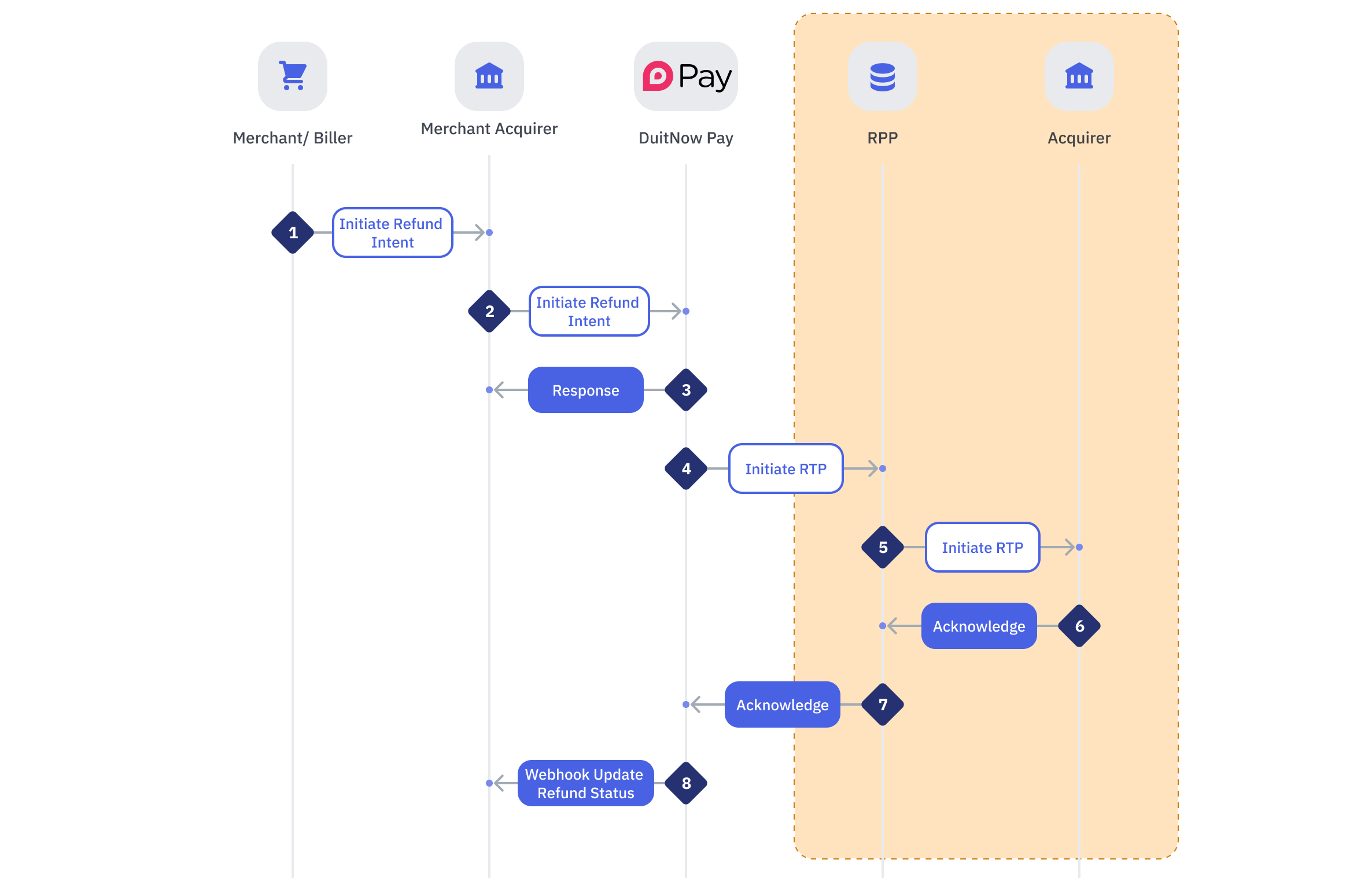

Refund Intent Initiation

In specific scenarios where a Merchant Acquirer is required to process a refund for their customer, they may initiate the refund intent via DuitNow Pay (DuitNow Pay Refund) or directly to RPP. The refund Intent will be transmitted to PayNet, which will then relay the Refund Intend to the Acquirer. Upon receipt, the Acquirer is required to acknowledge the request and proceed with the refund process by invoking the relevant API call to PayNet (DuitNow Reversal for Refund Intent).

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | Merchant/Biller | Merchant Acquirer | Merchant/Biller performs the following:

|

| 2 | Merchant Acquirer | DuitNow Pay | Merchant Acquirer performs the following:

|

| 3A | DuitNow Pay | Merchant Acquirer | Initiate refund via DuitNow Pay performs the following:

|

| 4 | DuitNow Pay | RPP | DuitNow Pay performs the following:

|

| 5 | RPP | Acquirer | RPP initiate Request to Pay to Acquirer Note: Transaction Type: 854 |

| 6 | Acquirer | RPP | Acquirer shall provide an acknowledgement back to RPP |

| 7 | RPP | DuitNow Pay | RPP shall provide an acknowledgement back to DuitNow Pay |

| 8 | DuitNow Pay | Merchant Acquirer | DuitNow Pay performs the following:

|