We've Launched a New Documentation Website (Beta Launch)

The documentation for DuitNow is now available on our newly launched documentation platform. This is an initial beta rollout of our new documentation site, designed to become the long-term home for all documentation moving forward.

You'll find the familiar content you're used to—now hosted on a new platform that will progressively receive updates and enhancements.

We encourage you to start accessing DuitNow materials there to explore the new experience and ensure you're viewing the latest documentation updates. If you have any feedback, please reach out to us.

Visit the New Documentation WebsitePay By Proxy

Pay by Proxy offers an alternative way for customers to make payments using a registered Proxy ID, such as a mobile number, NRIC, passport number, army number, or business registration number, instead of an account number.

The payment process is similar to DuitNow Transfer but requires initiating a Proxy Resolution Enquiry request instead of an Account Enquiry to retrieve the recipient’s name for confirmation. After the customer confirms the transaction details, including the Proxy ID and beneficiary name, the participant sends a Credit Request to RPP for processing.

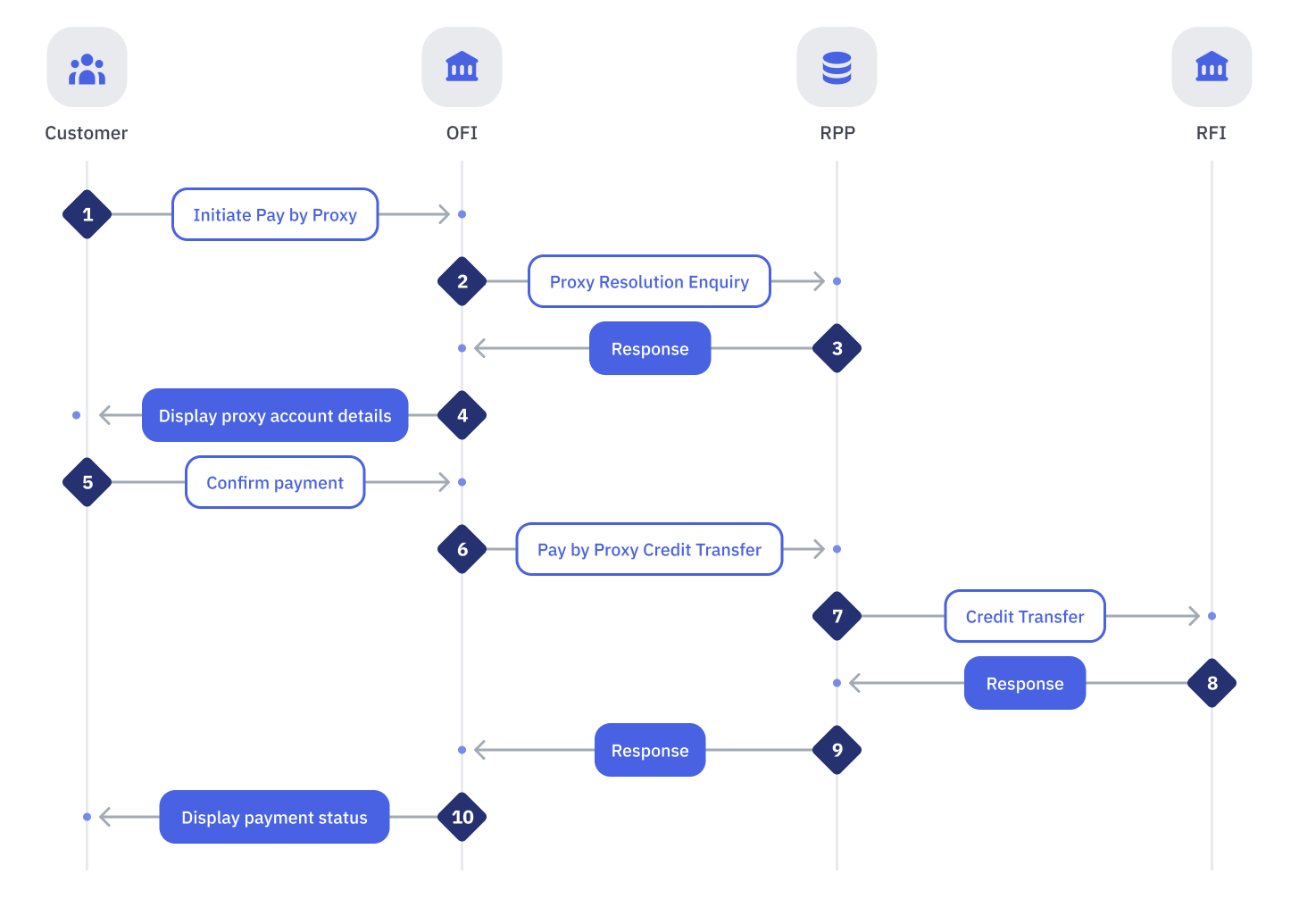

Successful End-to-End Pay by Proxy Flow

| Step | Sender | Receiver | Processes |

|---|---|---|---|

| 1 | Customer | Issuer (OFI) | Customer logs into Online Banking or Mobile Banking app and initiates a DuitNow Transfer – Pay-by-Proxy |

| 2 | Issuer (OFI) | RPP | OFI performs the following:

|

| 3 | RPP | Issuer (OFI) | RPP performs the following:If any of the validations are not successful:

|

| 4 | Issuer (OFI) | Customer | OFI performs the following:If all validations are successful:

|

| 5 | Customer | Issuer (OFI) | Customer verifies the beneficiary account details and confirms on the payment |

| 6 | Issuer (OFI) | RPP | OFI performs the following:

|

| 7 | RPP | Acquirer (RFI) | RPP performs the following:If any of the Message Validations fails:

|

| 8 | Acquirer (RFI) | RPP | RFI performs the following:If any of the Message Validations fails:

|

| 9 | RPP | Issuer (OFI) | RPP performs the following:If any of the Message Validations fails:

|

| 10 | Issuer (OFI) | Customer | OFI performs the following:If all validations are successful:

|

Proxy Resolution Enquiry

A proxy resolution enquiry is used to verify if a specific proxy is valid and ready to receive payments. This is important in several situations:

- Validating the beneficiary's account name before confirming a payment request.

- Ensuring recipient details before topping up an eWallet account.

This enquiry can be initiated during a Pay by Proxy transaction or as a standalone request by the customer. The table below provides guidance for participants on the information that should be displayed to the customer.

| No | Enquiry Scenario | Proxy Owned by | Enquiry By | Status | Expected Response | Displayed to Customer |

|---|---|---|---|---|---|---|

| 1 | Full Proxy Resolution | Participant A | Participant A | Active |

| Account Holder Name |

| 2 | Full Proxy Resolution | Participant B | Participant A | Active |

| Account Holder Name |

| 3 | Proxy Name Enquiry | Participant A | Participant A | Active |

| Account Holder Name |

| 4 | Proxy Name Enquiry | Participant B | Participant A | Active |

| Account Holder Name |

| 5 | Proxy Check | Participant A | Participant A | Active |

| Status |

| 6 | Proxy Check | Participant B | Participant A | Active |

| Status |

Credit Transfer

Pay by Proxy uses the same credit transfer process to move funds from the debtor’s bank account to the beneficiary’s account. This transaction can be initiated through various channels within the participant's ecosystem, such as Internet Banking, Mobile Banking, Branches, Kiosks, and more.

Sample Use Case

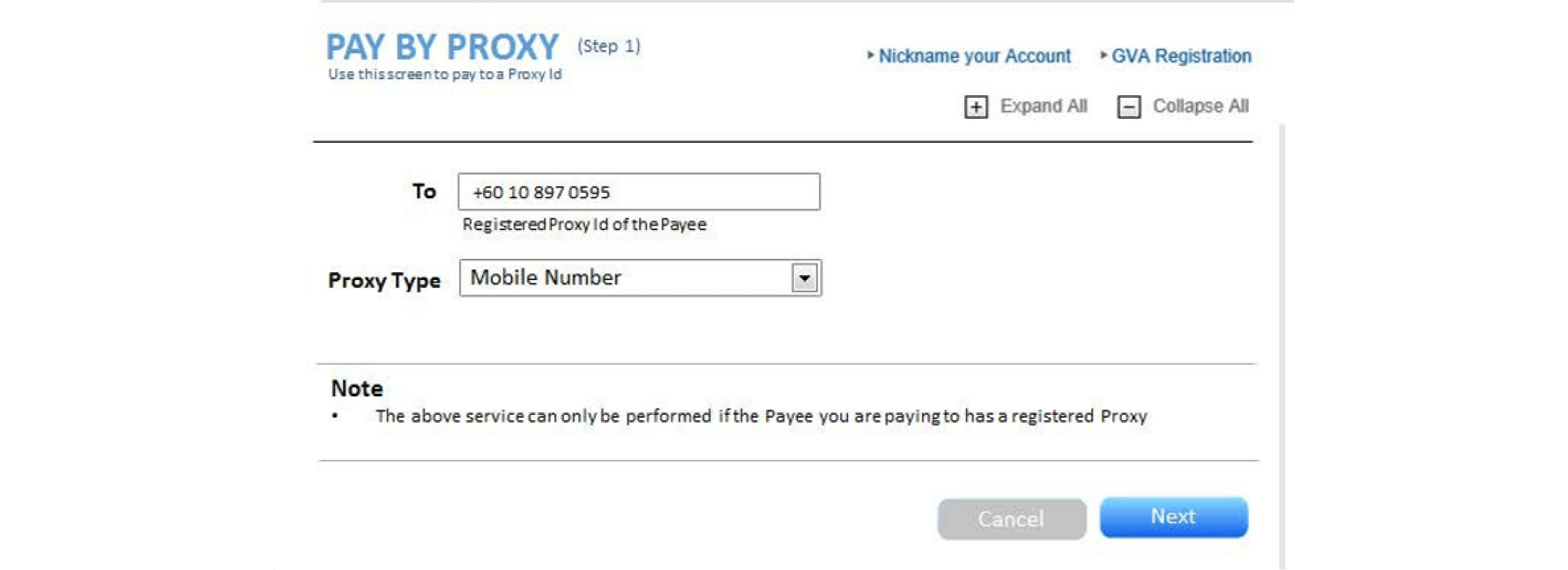

Pay-by-Proxy – Enter Proxy Details

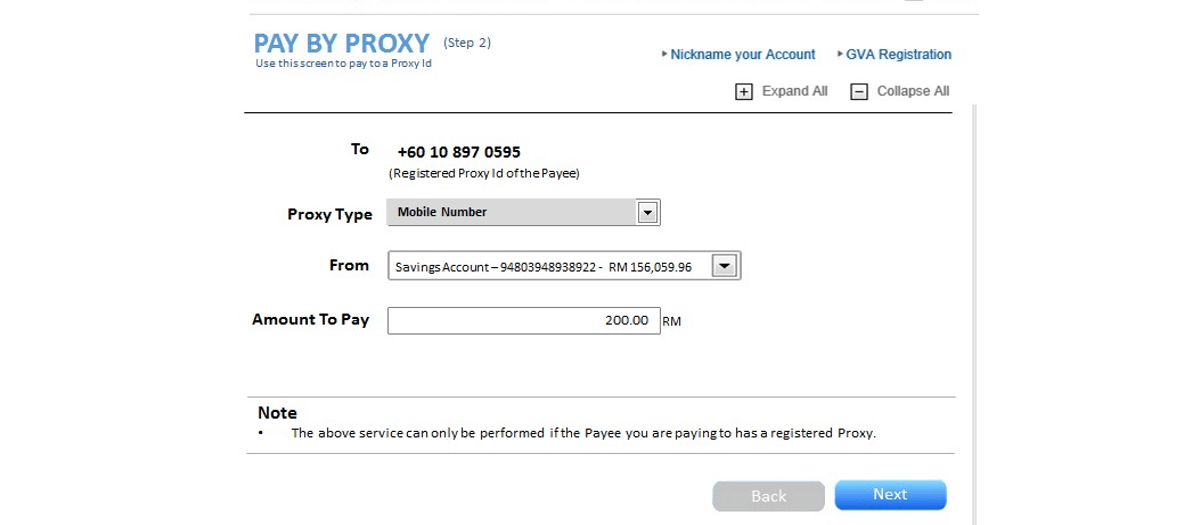

Pay-by-Proxy – Enter Payment Details

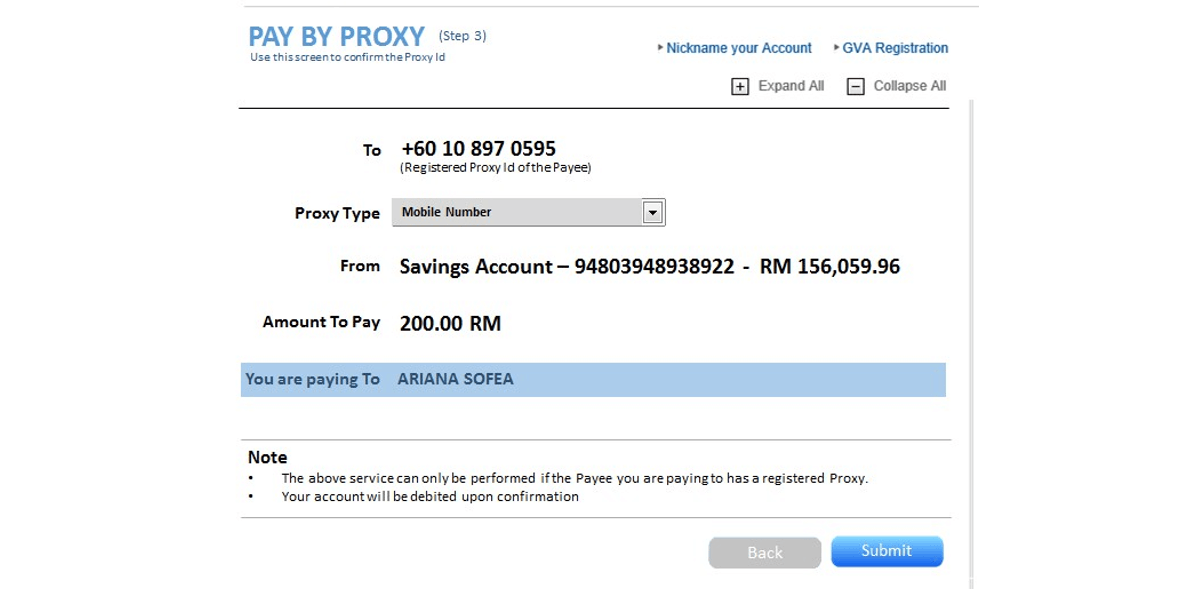

Pay-by-Proxy – Confirm Proxy ID, Name and Payment