Reporting Specifications

All reports shall be made available via the FI server. Participant that may require access to these reports shall apply the access credential through our administrator or Developer Portal.

Summary

Reports from RPP

| Report Code | Description | Naming Convention | Format | File Type | Frequency | Status |

|---|---|---|---|---|---|---|

| PSR02 | Participant Settlement File | RPP_<BICFI>_PSR02_<yyyymmdd>_<cycle> | TXT | Fixed-length | 2 cycles per day | Discontinued |

| RPP_<BICFI>_PSR02_<yyyymmdd>_DAILY | Daily | |||||

| CBPSR02 | Cross Border Participant Settlement File | RPP_<BICFI>_CBPSR02_<yyyymmdd>_<cycle> | TXT | Fixed-length | 2 cycles per day | Active |

| RPP_<BICFI>_CBPSR02_<yyyymmdd>_DAILY | Daily | |||||

| TAR02 | Transaction Daily File | RPP_<BICFI>_TAR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Discontinued |

| CBTAR02 | Cross Border Transaction Daily File | RPP_<BICFI>_CBTAR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| TAR04 | Transaction Settlement Cycle File | RPP_<BICFI>_TAR04_<yyyymmdd>_<cycle> | TXT | Delimited by "|" | 2 cycles per day | Discontinued |

| CBTAR04 | Cross Border Transaction Settlement Cycle File | RPP_<BICFI>_CBTAR04_<yyyymmdd>_<cycle> | TXT | Delimited by "|" | 2 cycles per day | Active |

| PFMR01 | Participant Fee Monthly Report | RPP_<BICFI>_PFMR01_<yyyymmdd> | - | Monthly | Discontinued | |

| PFMR02 | Participant Fee Monthly File | RPP_<BICFI>_PFMR02_<yyyymmdd> | TXT | Delimited by "|" | Monthly | Discontinued |

| SRTR02 | SAF Rejected Transactions File | RPP_<BICFI>_SRTR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| SRTR04 | SAF Successful Transactions File | RPP_<BICFI>_SRTR04_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| SER02 | SAF Exception File | RPP_<BICFI>_SER02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| NADM02 | NAD Maintenance File | RPP_<BICFI>_NADM02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| NUSR01 | NAD Usage Statistics Report | RPP_<BICFI>_NUSR01_<yyyymmdd> | Daily | Active | ||

| MRR02 | Merchant Registration File | RPP_<BICFI>_MRR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| CMR02 | Consent Maintenance File (CMR02) | RPP_<BICFI>_CMR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| CMR04 | Consent Maintenance File for Direct Debit (CMR04) | RPP_<BICFI>_CMR04_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| CBSF02 | Service Fee for DuitNow Cross Border Fund Transfer (CBSF02) | RPP_<BICFI>_CBSF02_<yyyymmdd> RPP_PAYNET_<Settlement Bank/Switch>_CBSF02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| RPPB02 | RPP and RPP-FPX Summary Cycle Report | RPP_<BICFI>_RPPB02_<yyyymmdd>_<cycle> | CSV | Delimited by "|" | 2 cycles per day | Active |

| RPPB03 | RPP-FPX Itemised Cycle Report | RPP_<BICFI>_RPPB03_<yyyymmdd>_<cycle> | CSV | Delimited by "|" | 2 cycles per day | Active |

| RTPSS02 | Request-to-Pay SAF Successful File | RPP_<BICFI>_RTPSS02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| RTPSR02 | Request-to-Pay SAF Rejected File | RPP<BICFI>_RTPSR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| RTPSE02 | Request-to-Pay SAF Exception File | RPP<BICFI>_RTPSE02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| RTPPS02 | Request-to-Pay Payment Successful File | RPP<BICFI>_RTPPS02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| RTPPR02 | Request-to-Pay Payment Rejected File | RPP<BICFI>_RTPPR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| RTPPE02 | Request-to-Pay Payment Exception File | RPP<BICFI>_RTPPE02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| CRSS02 | Consent Registration SAF Successful File | RPP_<BICFI>_CRSS02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| CRSR02 | Consent Registration SAF Rejected File | RPP_<BICFI>_CRSR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| CRSE02 | Consent Registration SAF Successful File | RPP_<BICFI>_CRSE02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

| RTDCR02 | Real Time Debit Cancellation File | RPP_<BICFI>_RTDCR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

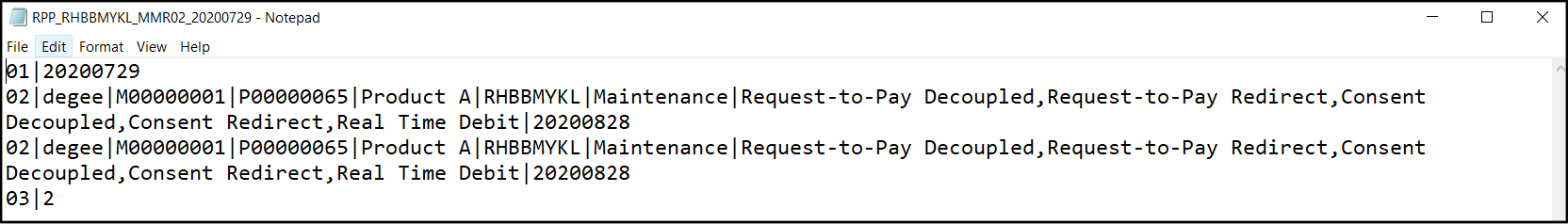

| MMR02 | Merchant Maintenance File | RPP_<BICFI>_MMR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

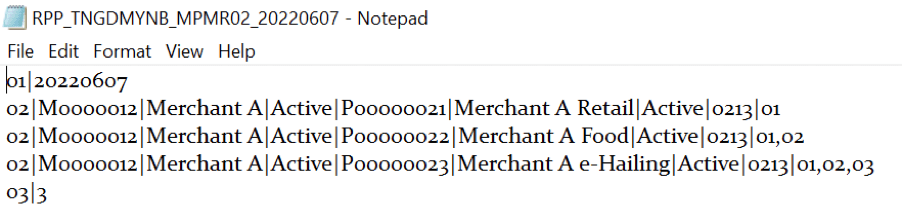

| MPMR02 | Merchant Product Maintenance File | RPP_<BICFI>_MPMR02_<yyyymmdd> | TXT | Delimited by "|" | Daily | Active |

Reports from FIs

| No. | Description | Naming Convention | Format | File Type | Frequency | Status |

|---|---|---|---|---|---|---|

| 1. | On-Us Itemised Report | <yyyymmdd><BICFI>01 | Data File (.txt) | Delimited (Delimiter: Pipe - |) | Daily | Active |

| 2. | On-Us Summarised Report | <yyyymmdd><BICFI>02 | Data File (.txt) | Delimited (Delimiter: Pipe - |) | Monthly | Active |

| 3. | QR Merchant Registration & Termination Report | <yyyymmdd><BICFI>03 | Data File (.txt) | Delimited (Delimiter: Pipe - |) | Monthly | Active |

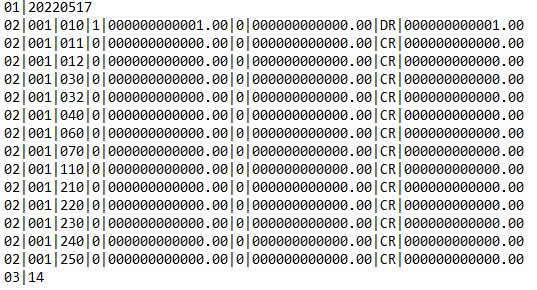

Participant Settlement File (PSR02) Discontinued

This is the RPP Settlement file generated for the Participants at each settlement cycle.

Layout

PSR02 (Cycle)

Download sample file

PSR02 (Daily)

Download sample file

Fields

Header:

| Field Name | Length | Description |

|---|---|---|

| RECORD TYPE | PIC 9 (02) | Value “01” to indicate HEADER record |

| REPORT DATE | PIC X (08) | Report Date in (yyyyMMdd) format. E.g. 20171023 |

Body:

| Field Name | Length | Description |

|---|---|---|

| RECORD TYPE | PIC 9 (02) | Value “02” to indicate rejected transaction records for that cycle |

| SETTLEMENT CYCLE | PIC 9 (02) | Settlement Cycle Value. E.g. "001" or "002" |

| SERVICE TYPE | PIC 9 (3) | Business purpose of the transaction i.e. Credit Transfer, Payment Return etc. (E.g 011 – Reverse Credit Transfer) |

| TRANS VOLUME (DR) | PIC 9 (18) | Total volume of debited record count. |

| TRANS AMT (DR) | PIC X (15) | Transaction Debited Amount. This amount will be presented in 999999999999.99 format. For e.g. RM 1000.00 will be shown as 000000001000.00 |

| TRANS VOLUME (CR) | PIC 9 (18) | Total volume of credited record count. |

| TRANS AMT (CR) | PIC X (15) | Transaction Credited Amount. This amount will be presented in 999999999999.99 format. For e.g. RM 1000.00 will be shown as 000000001000.00 |

| DEBIT CREDIT | PIC X (2) | This is the debit or credit for Nett Total amount. For e.g. CR is positive value while DR is negative value for Nett |

| NETT TOTAL | PIC X (15) | NETT TOTAL PIC X (15) Nett Transaction Amount. This amount will be presented in 999999999999.99 format. For e.g. RM 1000.00 will be shown as 000000001000.00 |

Footer:

| Field Name | Length | Description |

|---|---|---|

| RECORD TYPE | PIC 9 (02) | Value “03” to indicate FOOTER record |

| TOTAL RECORD COUNT | PIC 9 (18) | Total record count, excluding header and trailer records. |

Cross Border Participant Settlement File (CBPSR02)

This is the RPP Settlement file generated for the Participants at each settlement cycle for Cross-Border transactions.

Layout

CBPSR02 (Cycle)

Download sample file

CBPSR02 (Daily)

Download sample file

Fields

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER Record | Value “01” Numeric (2) |

| 2 | Report Date | Date the report is generated | <yyyyMMdd> Numeric (8) |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate rejected transaction records for that cycle | Value "02" Numeric (2) |

| 2 | Settlement Cycle | Settlement Cycle Value | "001" or "002" Numeric (3) |

| 3 | Service Type | Business purpose of the transaction : - 031 – Cross Border QR (POS) | Numeric (3) |

| 4 | Currency Code | Applicable currency used in the transaction | E.g. THB, SGD, IDR Alphabet (3) |

| 5 | Trans Volume (DR) | Total volume of debited record count. | Numeric (15) |

| 6 | Trans Amt (DR) | Total transaction debit amount in MYR | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 Decimal (15,2) |

| 7 | Foreign Amount (DR) | Total transaction debit amount in foreign currency | Decimal (15,2) |

| 8 | Trans Volume (CR) | Total volume of credited record count | Numeric (15) |

| 9 | Trans Amt (CR) | Total transaction credit amount in MYR | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 Decimal (15,2) |

| 10 | Foreign Amount (CR) | Total transaction credit amount in foreign currency | Decimal (15,2) |

| 11 | Debit Credit | This is the debit or credit for Nett Total amount. For e.g. CR is positive value while DR is negative value for Nett Total. | Decimal (15,2) |

| 12 | Nett Total | Nett Transaction Amount in MYR | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 Decimal (15,2) |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER Record | Value “03” Numeric (2) |

| 2 | Total Record Count | Total record count, excluding header and trailer records. | Numeric (15) |

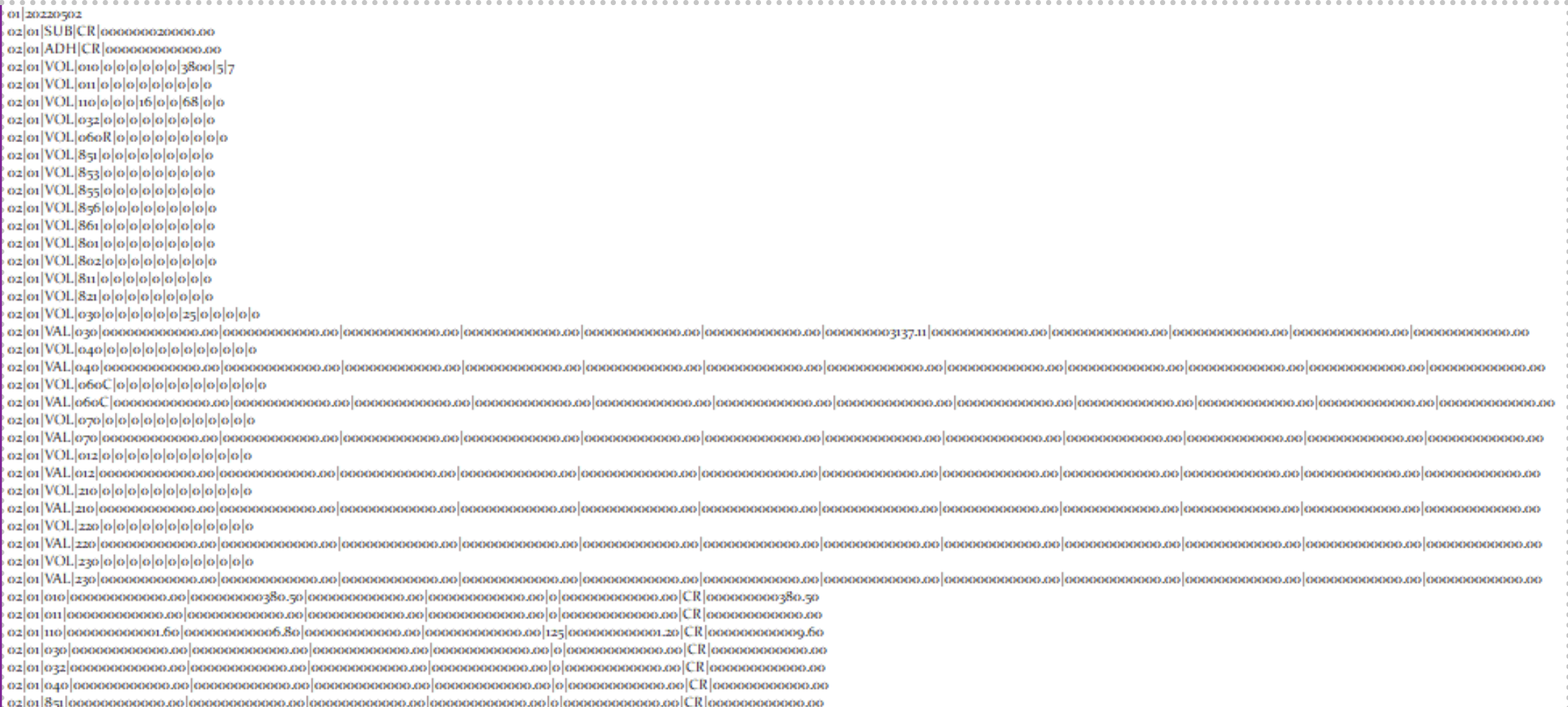

Participant Fee Monthly Report (PFMR01) Discontinued

This is a monthy report generated to inform Participants of the fees incurred within the month.

Fields

| Column | Field Name | Description |

|---|---|---|

| 1 | TRANS DATE | Transaction Date |

| 2 | SCHEME | Fee Scheme ID |

| 3 | OFI TRANS VOLUME | Transaction Volume Initiated as OFI |

| 4 | TRANS PRF | Processing Fee for OFI Transactions due to RPP |

| 5 | TRANS CRF | Capture Reimbursement Fee for OFI Transactions due to RPP |

| 6 | CC TRANS VALUE | Credit Card Transaction Value for OFI Transactions |

| 7 | CC FEE | Credit Card Transaction Fee for OFI Transactions due to RPP |

| 8 | NAD VOLUME | NAD Message Volume |

| 9 | NAD FEE | NAD Message Fees |

| 10 | TOTAL PAYABLE FEE | Total Fee Due to RPP for OFI Transactions |

| 11 | RFI TRANS VOLUME | Transaction Volume Received as RFI |

| 12 | TRANS CRF | Capture Reimbursement Fee for RFI Transactions due from RPP |

| 13 | CC TRANS VALUE | Credit Card Transaction Value as RFI |

| 14 | CC FEE | Credit Card Transaction Fee for RFI Transactions due from RPP |

| 15 | TOTAL RECEIVABLE FEE | Total Fee Due from RPP for RFI Transactions |

| 16 | NETT TOTAL | TOTAL RECEIVABLE FEE - TOTAL PAYABLE FEE |

Participant Fee Monthly File (PFMR02) Discontinued

This is a monthy report generated to inform Participants of the fees incurred within the month.

Layout

Fields

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER Record | Value “01” Numeric (2) |

| 2 | Report Date | Date the report is generated | <yyyyMMdd> Numeric (8) |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" |

| 2 | Scheme | Fee Scheme ID | |

| 3 | Minimum Monthly Transaction Fee (RM) | Minimum Monthly Transaction Fee (RM) | Presented in 2 decimal places |

| 4 | Ad Hoc Fee | Ad Hoc Fee | Presented in 2 decimal places |

| 5 | Service Type | Service Type | |

| 6 | On-Us Transaction (By Participant) | On-Us Transaction Volume that Participant processed internally (volume and value for certain service type) | |

| 7 | On-Us Transaction (By RPP) | On-Us Transaction Volume that RPP processed (volume and value for certain service type) | |

| 8 | Off-Us Transaction | Off-Us Transaction Volume (outgoing/incoming and volume/value for certain service type) | |

| 9 | On-Us Transaction Processing Fee | On-Us Transaction Processing Fee | Presented in 2 decimal places |

| 10 | Off-Us Transaction Processing Fee | Off-Us Transaction Processing Fee | Presented in 2 decimal places |

| 11 | Off-Us Transaction Capture Reimbursement Fee | Off-Us Transaction Capture Reimbursement Fee | Presented in 2 decimal places |

| 12 | Off-Us Transaction LOCAF Fee | Off-Us Transaction LOCAF Fee | Presented in 2 decimal places |

| 13 | Inquiry Volume | Inquiry Volume | |

| 14 | Proxy Resolution Fee | Proxy Resolution Fee | Presented in 2 decimal places |

| 15 | Total Fee | Total Fee | Presented in 2 decimal places |

| 16 | Nett Total | Nett Total | Presented in 2 decimal places |

| 17 | MTD | Month-to-Date (from start until the end of the month) | |

| 18 | Transaction Volume | Total numbers of industry transaction volume by service type within the month | |

| 19 | Transaction Value | Total value of industry transaction by service type within the month | Presented in 2 decimal places |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER Record | Value “03” Numeric (2) |

| 2 | Total Record Count | Total record count, excluding header and trailer records. | Numeric (15) |

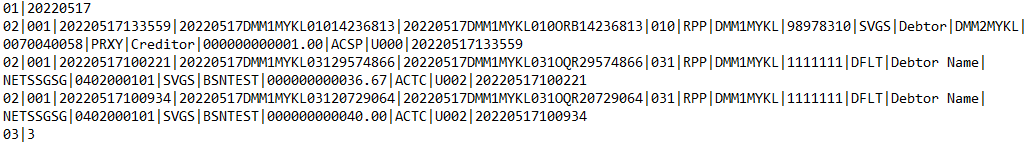

Transaction Daily File (TAR02) Discontinued

This is a daily file generated that contains all the RPP transactions initiated by the Participants. This can be used by the Participants to reconcile transactions against the settlement amount.

Layout

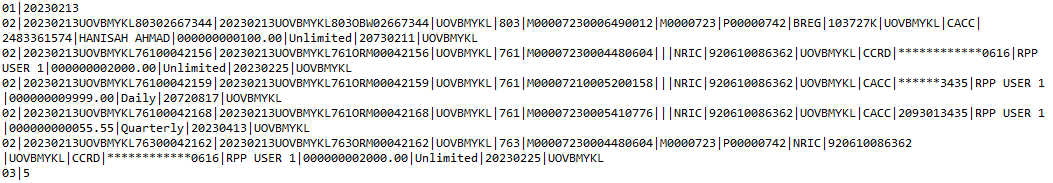

TAR02 Sample File

Download sample file

Fields

Header:

| Field Name | Length | Description |

|---|---|---|

| RECORD TYPE | PIC 9 (02) | Value “01” to indicate Header record |

| REPORT DATE | PIC X (08) | Report Date in yyyyMMdd format. E.g. 20171023 |

Body:

| Field Name | Length | Description |

|---|---|---|

| RECORD TYPE | PIC 9 (02) | Value “02” to indicate Transaction records |

| SETTLEMENT CYCLE | PIC 9 (03) | Settlement Cycle Value. E.g. "001" or "002" |

| INITIATION DATE | PIC X (14) | Date and time at which the transaction was created (yyyymmddhhmmss) |

| MSG ID | PIC X (35) | Transaction reference set by the Originator bank (OFI) |

| BUSINESS MSG ID | PIC X (35) | Business Message Id from the OFI |

| SERVICE | PIC 9 (3) | Business purpose of the transaction i.e. Credit Transfer, Payment Return etc. (E.g 011 – Reverse Credit Transfer) |

| SCHEME ID | PIC X (8) | Name of the scheme that manages a creditor or debtor of the non-participating bank to process their payments. Scheme has a direct relationship with the process |

| OFI CODE | PIC X (8) | Financial institution servicing an account for the debtor |

| OFI ACC NO | PIC 9 (34) | Debtor’s Account Number |

| OFI ACC TYPE | PIC X (4) | Debtor’s Account Type |

| OFI ACC NAME | PIC X (140) | Debtor’s Name |

| RFI CODE | PIC X (8) | Financial institution servicing an account for the creditor |

| RFI ACC NO | PIC 9 (34) | Creditor Account Number |

| RFI ACC TYPE | PIC X (4) | Creditor’s Account Type |

| RFI ACC NAME | PIC X (140) | Creditor Name |

| TRANS AMOUNT | PIC X (15) | Transaction Amount or Reversed Amount. This amount will be presented in 999999999999.99 format. For e.g. RM 1000.00 will be shown as 000000001000.00 |

| TRANS STATUS | PIC X (4) | Status of the transaction |

| TRANS SUB CODE | PIC X (4) | Transaction's sub response code for Transactions under ACCEPTED status |

| COMPLETED DATE | PIC X (14) | Date and time at which the transaction was completed (yyyymmddhhmmss) |

Footer:

| Field Name | Length | Description |

|---|---|---|

| RECORD TYPE | PIC 9 (02) | Value “03” to indicate Footer record |

| TOTAL RECORD COUNT | PIC 9 (18) | Total record count, excluding header and trailer records. |

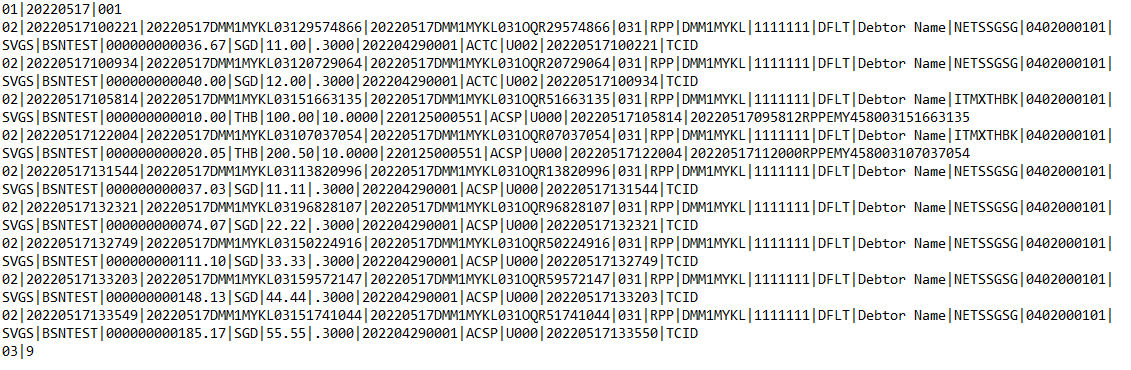

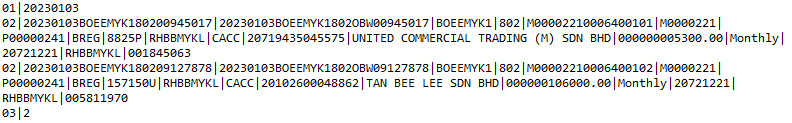

Cross Border Transaction Daily File (CBTAR02)

This is a daily file generated that contains all the cross-border RPP transactions initiated by the Participants. This can be used by the Participants to reconcile transactions against the settlement amount.

Layout

CBTAR02 Sample File

Download sample file

Fields

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER Record | Value “01” Numeric (2) |

| 2 | Report Date | Date the report is generated | <yyyyMMdd> Numeric (8) |

Body:

| Column | Field Name | Description | Format | |

|---|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" Numeric (2) | |

| 2 | Settlement Cycle | Settlement Cycle Value | "001" or "002" Numeric (3) | |

| 3 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> Numeric (14) | |

| 4 | Message ID | Transaction reference set by the Originator bank (OFI) | AlphaNumeric (35) | |

| 5 | Business Message ID | Business Message Id from the OFI | AlphaNumeric (35) | |

| 6 | Service Type | Business purpose of the transaction i.e. 031 – Cross Border QR (POS) | Numeric(3) | |

| 7 | Scheme Id | Name of the scheme that manages a creditor or debtor of the non-participating bank to process their payments. Scheme has a direct relationship with the process | Alphanumeric(3) | |

| 8 | OFI Code | Financial institution servicing an account for the payer | Alphanumeric (8) | |

| 9 | OFI Acct Acc | Payer’s Account Number | Alphanumeric (40) | |

| 10 | Acct Type | Payer’s Account Type | Alphabet (4) | |

| 11 | Acct Name | Payer’s Name | Freeform (140) | |

| 12 | RFI Code | Financial institution servicing an account for the merchant | Alphanumeric (8) | |

| 13 | RFI Acct No | Merchant Account Number | Alphanumeric (40) | |

| 14 | Acct Type | Creditor’s Account Type | Alphabet (4) | |

| 15 | Acct Name | Creditor Name | Freeform (140) | |

| 16 | Trans Amount | Transaction Amount in MYR | Decimal (15,2) | |

| 17 | Currency | Transaction Currency | Alphabet (3) | |

| 18 | Foreign Amt. | Transaction Amount in Foreign Currency | Decimal (15,2) | |

| 19 | FX Rate | Applicable FX Rate | Presented in 4 – 6 decimals | Decimal (15,6) |

| 20 | FX Ref. No. | Ref. No. for FX Rate quoted | Numeric (12) | |

| 21 | Trans Status | Status of the transaction | Alphabet (4) | |

| 22 | Trans Sub Code | Transaction's sub response code for Transactions | Alphanumeric (4) | |

| 23 | Completed Date | Date and time at which the transaction was completed | <yyyymmddhhmmss> Numeric (14) | |

| 24 | Payment Description | Participating Switch’s Transaction ID | Alphanumeric (40) |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER Record | Value “03” Numeric (2) |

| 2 | Total Record Count | Total record count, excluding header and trailer records. | Numeric (15) |

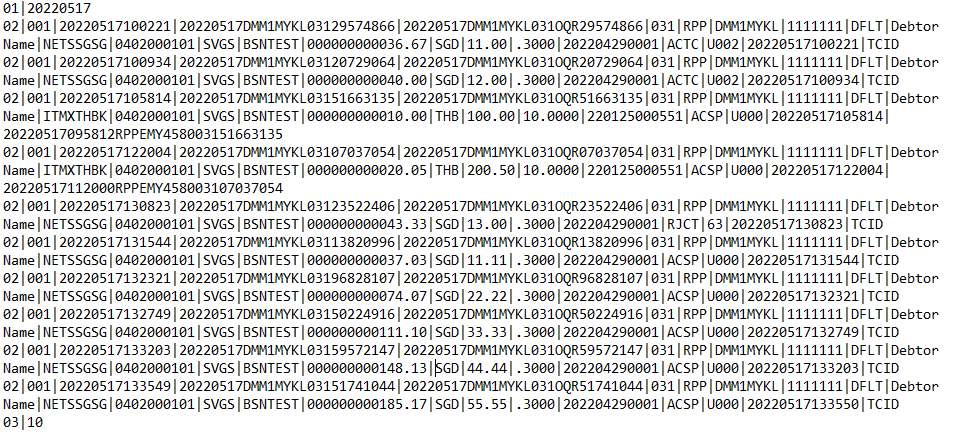

Transaction Settlement Cycle File (TAR04) Discontinued

This is a daily file generated that contains all the RPP transactions initiated by the Participants as well as received by the Participants.

Layout

The OFI Code (FPXRPPMY) denotes RPP-FPX transactions.

TAR04 Sample File

Download sample file

Fields

Header:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “01” to indicate HEADER record |

| Report Date | PIC X (08) | Report Date in yyyymmdd format. E.g. 20171023 |

| Settlement Cycle | PIC 9 (03) | Settlement Cycle Value. E.g. "001" or "002" |

Body:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “02” to indicate Transaction records |

| Initiation Date | PIC X (14) | Date and time at which the transaction was created (yyyymmddhhmmss) |

| Message Id | PIC X (35) | Transaction reference set by the Originator bank (OFI) |

| Business Message Id | PIC X (35) | Business Message Id from the OFI |

| Service | PIC 9 (3) | Business purpose of the transaction i.e. Credit Transfer, Payment Return etc. (E.g 011 – Reverse Credit Transfer) |

| Scheme Id | PIC X (8) | Name of the scheme that manages a creditor of the non-participating bank to process their payments |

| OFI Code | PIC X (8) | Financial institution servicing an account for the debtor Note: The OFI Code (FPXRPPMY) denotes RPP-FPX transactions |

| OFI Account Number | PIC 9 (34) | Debtor’s Account Number |

| OFI Account Type | PIC X (4) | Debtor’s Account Type |

| OFI Account Name | PIC X (140) | Debtor’s Name |

| RFI Code | PIC X (8) | Financial institution servicing an account for the creditor |

| RFI Account Number | PIC 9 (34) | Creditor Account Number |

| RFI Account Type | PIC X (4) | Creditor’s Account Type |

| RFI Account Name | PIC X (140) | Creditor Name |

| Transaction Amount | PIC X (15) | Transaction Amount or Reversed Amount. This amount will be presented in 999999999999.99 format. For e.g. RM1000.00 will be shown as 000000001000.00 |

| Transaction Status | PIC X (4) | Status of the transaction |

| Transaction Sub Code | PIC X (4) | Transaction's sub response code for Transactions under ACCEPTED status |

| Completed Date | PIC X (14) | Date and time at which the transaction was completed (yyyymmddhhmmss) |

Footer:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “03” to indicate FOOTER record |

| Total Record Count | PIC 9 (18) | Total record count, excluding header and trailer records. |

Below are sample scripts provided to help you better understand how to separate the RPP-FPX transactions from the TAR04 report, enabling you to perform daily reconciliation more easily.

Shell Script:

#!/bin/bash

# Input file

INPUT_FILE="RPP_BANKMYKL_TAR04_20250223_001.txt"

# Output files

FILE_A="TAR04_RPPFPX_20250223_001.txt"

FILE_B="TAR04_RPP_20250223_001.txt"

# Clear previous output files

> "$FILE_A"

> "$FILE_B"

# Process the input file line by line

countA=1

countB=1

while IFS= read -r line; do

type=$(echo "$line" | cut -d'|' -f1)

indicator=$(echo "$line" | cut -d'|' -f7)

if [ "$type" = "01" ]; then

echo "$line" >> "$FILE_A"

echo "$line" >> "$FILE_B"

elif [ "$type" = "02" ]; then

if [ "$indicator" = "FPXRPPMY" ]; then

echo "$line" >> "$FILE_A"

countA=$((countA+1))

else

echo "$line" >> "$FILE_B"

countB=$((countB+1))

fi

fi

done < "$INPUT_FILE"

printf "03|$countA" >> "$FILE_A"

printf "03|$countB" >> "$FILE_B"

echo "Separation complete. Records saved to $FILE_A and $FILE_B"

JavaScript:

const fs = require("fs");

const readline = require("readline");

// Input & output file names

const inputFile = "RPP_BANKMYKL_TAR04_20250223_001.txt"; // original file with all records

const outputFile1 = "TAR04_RPPFPX_20250223_001.txt"; // records with indicator "RPP-FPX"

const outputFile2 = "TAR04_RPP_20250223_001.txt"; // all other records

// Create write streams for output files

const outStream1 = fs.createWriteStream(outputFile1, { flags: "w" });

const outStream2 = fs.createWriteStream(outputFile2, { flags: "w" });

// Create line reader

const rl = readline.createInterface({

input: fs.createReadStream(inputFile),

crlfDelay: Infinity,

});

let count1 = 1;

let count2 = 2;

rl.on("line", (line) => {

const fields = line.split("|");

const type = fields[0];

const indicator = fields[6];

if (type === "01") {

outStream1.write(line + "\n");

outStream2.write(line + "\n");

} else if (type === "02") {

if (indicator === "FPXRPPMY") {

outStream1.write(line + "\n");

count1++;

} else {

outStream2.write(line + "\n");

count2++;

}

}

});

rl.on("close", () => {

outStream1.write(`03|${count1}`);

outStream2.write(`03|${count2}`);

console.log("Separation completed!");

outStream1.end();

outStream2.end();

});

Python Script:

# Input & output file names

input_file = "RPP_BANKMYKL_TAR04_20250223_001.txt" # original file with all records

output_file1 = "TAR04_RPPFPX_20250223_001.txt" # records with indicator "RPP-FPX"

output_file2 = "TAR04_RPP_20250223_001.txt" # all other records

indicator_check = "FPXRPPMY"

count1=1

count2=1

with open(input_file, "r") as infile, \

open(output_file1, "w") as out1, \

open(output_file2, "w") as out2:

for line in infile:

fields = line.split("|")

type = fields[0]

if type == "01":

out1.write(line)

out2.write(line)

elif type == "02":

indicator = fields[6]

if indicator == indicator_check:

out1.write(line)

count1 += 1

else:

out2.write(line)

count2 += 1

else:

out1.write(f"03|{count1}")

out2.write(f"03|{count2}")

print("Separation completed!")

Cross Border Transaction Settlement Cycle (CBTAR04)

This is a daily file generated that contains all the cross-border transactions initiated by the Participants as well as received by the Participants.

Layout

CBTAR04 Sample File

Download sample file

CBPSR02 (Daily)

Download sample file

Fields

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER Record | Value “01” Numeric (2) |

| 2 | Report Date | Date the report is generated | <yyyyMMdd> Numeric (8) |

| 3 | Settlement Cycle | Settlement Cycle Value | "001" or "002" Numeric (3) |

Body:

| Column | Field Name | Description | Format | |

|---|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" Numeric (2) | |

| 2 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> Numeric (14) | |

| 3 | Message ID | Transaction reference set by the Originator bank (OFI) | AlphaNumeric (35) | |

| 4 | Business Message ID | Business Message Id from the OFI | AlphaNumeric (35) | |

| 5 | Service Type | Business purpose of the transaction i.e. 031 – Cross Border QR (POS) | Numeric(3) | |

| 6 | Scheme Id | Name of the scheme that manages a creditor or debtor of the non-participating bank to process their payments. Scheme has a direct relationship with the process | Alphanumeric(3) | |

| 7 | OFI Code | Financial institution servicing an account for the payer | Alphanumeric (8) | |

| 8 | OFI Acct Acc | Payer’s Account Number | Alphanumeric (40) | |

| 9 | Acct Type | Payer’s Account Type | Alphabet (4) | |

| 10 | Acct Name | Payer’s Name | Freeform (140) | |

| 11 | RFI Code | Financial institution servicing an account for the merchant | Alphanumeric (8) | |

| 12 | RFI Acct No | Merchant Account Number | Alphanumeric (40) | |

| 13 | Acct Type | Creditor’s Account Type | Alphabet (4) | |

| 14 | Acct Name | Creditor Name | Freeform (140) | |

| 15 | Trans Amount | Transaction Amount in MYR | Decimal (15,2) | |

| 16 | Currency | Transaction Currency | Alphabet (3) | |

| 17 | Foreign Amt. | Transaction Amount in Foreign Currency | Decimal (15,2) | |

| 18 | FX Rate | Applicable FX Rate | Presented in 4 – 6 decimals | Decimal (15,6) |

| 19 | FX Ref. No. | Ref. No. for FX Rate quoted | Numeric (12) | |

| 20 | Trans Status | Status of the transaction | Alphabet (4) | |

| 21 | Trans Sub Code | Transaction's sub response code for Transactions | Alphanumeric (4) | |

| 22 | Completed Date | Date and time at which the transaction was completed | <yyyymmddhhmmss> Numeric (14) | |

| 23 | Payment Description | Participating Switch’s Transaction ID | Alphanumeric (40) |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER Record | Value “03” Numeric (2) |

| 2 | Total Record Count | Total record count, excluding header and trailer records. | Numeric (15) |

SAF Rejected Transactions File (SRTR02)

This report contains transactions that were rejected by the RFI during the store and forward process. These records will be extracted from the SAF table whose transaction status is RJCT. This will only include those transactions that were rejected outright by the RFI. It will not include those rejected transactions due to timeout.

Layout

SRTR02 Sample File

Download sample file

Fields

Header:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “01” to indicate HEADER record |

| Report Date | PIC X (08) | Report Date in (yyyyMMdd) format. E.g. 20171023 |

Body:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “02” to indicate rejected transaction records for that cycle |

| Initiation Date | PIC X (14) | Date and time at which the transaction was created (yyyymmddhhmmss) |

| Message ID | PIC X (35) | Transaction reference set by the Originator bank (OFI) |

| Business Message Id | PIC X (35) | Business Message Id from the OFI |

| Service | PIC 9 (3) | Business purpose of the transaction i.e. Credit Transfer, Payment Return etc. (E.g 011 – Reverse Credit Transfer) |

| Scheme Id(Creditor Bank) | PIC X (8) | Name of the scheme that manages a creditor of the non-participating bank to process their payments. Scheme has adirect relationship with the process |

| OFI Code | PIC X (8) | Financial institution servicing an account for the debtor |

| OFI Account Id | PIC 9 (34) | Debtor’s Account Number |

| OFI Account Type | PIC X (4) | Debtor’s Account Type |

| OFI Name | PIC X (140) | Debtor’s Name |

| RFI Code | PIC X (8) | Financial institution servicing an account for the creditor |

| RFI Account Id | PIC X (35) | Creditor Account Number |

| RFI Account Type | PIC X (4) | Creditor’s Account Type |

| RFI Name | PIC X (140) | Creditor’s Name |

| Transaction Amount | PIC X (15) | Transaction Amount or Reversed Amount. This amount will be presented in 999999999999.99 format. |

Footer:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “03” to indicate FOOTER record |

| Total Record Count | PIC 9 (18) | Total record count, excluding header and trailer records |

SAF Successful Transactions File (SRTR04)

This report contains transactions that were successful accepted by the RFI during the store and forward process.

Layout

SRTR04 Sample File

Download sample file

Fields

Header:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “01” to indicate HEADER record |

| Report Date | PIC X (08) | Report Date in (yyyyMMdd) format. E.g. 20171023 |

Body:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “02” to indicate rejected transaction records for that cycle |

| Initiation Date | PIC X (14) | Date and time at which the transaction was created (yyyymmddhhmmss) |

| Message ID | PIC X (35) | Transaction reference set by the Originator bank (OFI) |

| Business Message Id | PIC X (35) | Business Message Id from the OFI |

| Service | PIC 9 (3) | Business purpose of the transaction i.e. Credit Transfer, Payment Return etc. (E.g 011 – Reverse Credit Transfer) |

| Scheme Id(Creditor Bank) | PIC X (8) | Name of the scheme that manages a creditor of the non-participating bank to process their payments. Scheme has adirect relationship with the process |

| OFI Code | PIC X (8) | Financial institution servicing an account for the debtor |

| OFI Account Id | PIC 9 (34) | Debtor’s Account Number |

| OFI Account Type | PIC X (4) | Debtor’s Account Type |

| OFI Name | PIC X (140) | Debtor’s Name |

| RFI Code | PIC X (8) | Financial institution servicing an account for the creditor |

| RFI Account Id | PIC X (35) | Creditor Account Number |

| RFI Account Type | PIC X (4) | Creditor’s Account Type |

| RFI Name | PIC X (140) | Creditor’s Name |

| Transaction Amount | PIC X (15) | Transaction Amount or Reversed Amount. This amount will be presented in 999999999999.99 format. |

Footer:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “03” to indicate FOOTER record |

| Total Record Count | PIC 9 (18) | Total record count, excluding header and trailer records |

NAD Maintenance File (NADM02)

This file contains all the NAD transactions initiated by the Participant within the day.

Layout

NADM02 Sample File

Download sample file

Fields

Header:

| Field Name | Description | Format |

|---|---|---|

| Record Type | To indicate HEADER record | Value “01” |

| Report Date | The Date the Report is generated for | yyyyMMdd |

Body:

| Field Name | Description | Format |

|---|---|---|

| Record Type | Indicate maintained NAD records for that day | Value “02” |

| Business Message ID | Business Message Id from the OFI | yyyymmddhhmmss |

| OFI BIC Code | BIC Code of OFI | |

| Maintenance Type | Type of maintenance that was carried out on the NAD proxy record | |

| Proxy Type | Type of proxy record being maintained | |

| Proxy ID | Value being set as the Proxy ID | Revel Account Detail (Clear Text) |

| Secondary ID Type | Type of Secondary ID record used | |

| SECONDARY ID | Customer's secondary ID value being set | Revel Account Detail (Clear Text) |

| Bank Code | BIC Code of Account Holder Bank | |

| Account Number | Account number being tagged to the proxy record | |

| Account Type | Account Type being tagged to the proxy record | |

| Account Name | Account name being tagged to the proxy record | |

| Registration ID | Unique ID to represent the NAD proxy record | |

| Completion Date | Date of transaction | yyyyMMdd |

Footer:

| Field Name | Description | Format |

|---|---|---|

| Record Type | Indicate FOOTER record | Value “03” |

| Total Record Count | Total record count, excluding header and trailer records |

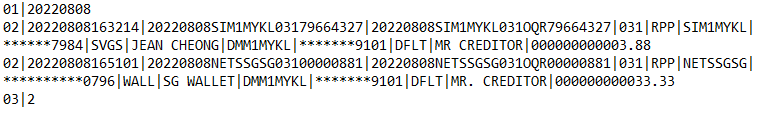

NAD Usage Statistics Report (NUSR01)

NAD Usage Statistics Report contains reports on proxy administration and usage per channel and customer types. This report will be generated per Participant.

Layout

NUSR01 Sample Report

Download sample file

Fields

Report Header:

| Column | Field Name | Description |

|---|---|---|

| 1 | Report Name | Name of the Report |

| 2 | Report Date | Date the report is generated |

| 3 | Participant ID | BIC Code of the Bank |

Report Body:

| Column | Field Name | Description |

|---|---|---|

| 1 | Customer Type | Customer Type (E.g. Retail or Corporate) |

| 2 | Channel | Channel Name (E.g. Internet Banking, Mobile Banking etc) |

| 3 | No of Look-Ups Requested | The number of Look-Ups requested |

| 4 | No of Look-Ups Responded | The number of Look-Ups performed where the recipient is the Participant's customer(s) |

| 5 | Successful Registration | The number of successful registrations (new) |

| 6 | Unsuccessful Registration | The number of unsuccessful registrations (new) |

| 7 | Deregistration | The number of deactivated registrations |

Report Footer:

| Column | Field Name | Description |

|---|---|---|

| 1 | Active DuitNow NAD | Total active DuitNow NAD |

| 2 | Inactive DuitNow NAD | Total inactive DuitNow NAD |

SAF Exception File (SER02)

SAF Exception File contains all those transactions that have not been cleared from SAF. Reasons for the exception can be any of the following:

- Timeout in RPP when sending SAF transactions

- RFI is inactive so SAF transactions cannot be sent

Layout

SER02 Sample File

Download sample file

Fields

Header:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “01” to indicate HEADER record |

| Report Date | PIC X (08) | Report Date in (yyyyMMdd) format. E.g. 20171023 |

Body:

| Field Name | Length | Description |

|---|---|---|

| RECORD TYPE | PIC 9 (02) | Value “02” to indicate Transaction records |

| SETTLEMENT CYCLE | PIC 9 (03) | Settlement Cycle Value. E.g. "001" or "002" |

| INITIATION DATE | PIC X (14) | Date and time at which the transaction was created (yyyymmddhhmmss) |

| MSG ID | PIC X (35) | Transaction reference set by the Originator bank (OFI) |

| BUSINESS MSG ID | PIC X (35) | Business Message Id from the OFI |

| SERVICE | PIC 9 (3) | Business purpose of the transaction i.e. Credit Transfer, Payment Return etc. (E.g 011 – Reverse Credit Transfer) |

| SCHEME ID | PIC X (8) | Name of the scheme that manages a creditor or debtor of the non-participating bank to process their payments. Scheme has a direct relationship with the process |

| OFI CODE | PIC X (8) | Financial institution servicing an account for the debtor |

| OFI ACC NO | PIC 9 (34) | Debtor’s Account Number |

| OFI ACC TYPE | PIC X (4) | Debtor’s Account Type |

| OFI ACC NAME | PIC X (140) | Debtor’s Name |

| RFI CODE | PIC X (8) | Financial institution servicing an account for the creditor |

| RFI ACC NO | PIC 9 (34) | Creditor Account Number |

| RFI ACC TYPE | PIC X (4) | Creditor’s Account Type |

| RFI ACC NAME | PIC X (140) | Creditor Name |

| TRANS AMOUNT | PIC X (15) | Transaction Amount or Reversed Amount. This amount will be presented in 999999999999.99 format. For e.g. RM 1000.00 will be shown as 000000001000.00 |

Footer:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (02) | Value “03” to indicate FOOTER record |

| Total Record Count | PIC 9 (18) | Total record count, excluding header and trailer records. |

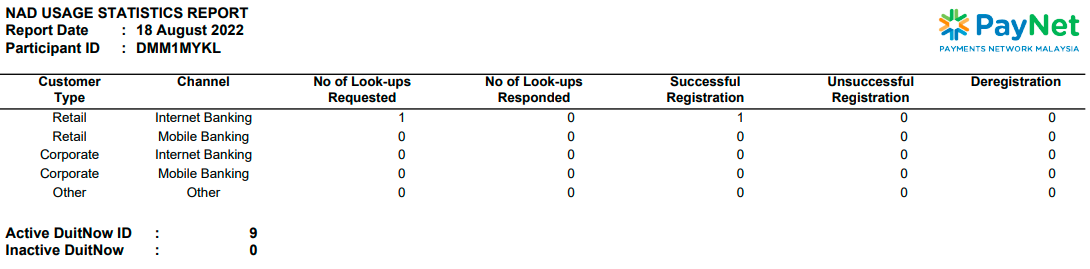

Merchant Registration File (MRR02)

This file contains the merchant acquired by Participants.

Layout

MRR02 Sample File

Download sample file

Fields

Header:

| Field Name | Description |

|---|---|

| Record Type | Value “01” to indicate HEADER record |

| Report Date | Date the Report generated for in format (yyyyMMdd) |

Body:

| Field Name | Description |

|---|---|

| Record Type | Value “02” to indicate Transaction records |

| Merchant Name | Merchant Name |

| BRN No. | Merchant’s Business Registration Number |

| Segment | Merchant's Segment |

| Sector | Merchant Business Sector |

| Business Category | Merchant’s Business Category |

| Merchant ID | Merchant ID |

| Product ID | Product ID |

| Product Name | Name of Product |

| Acquiring Bank | Merchant's Acquiring Bank |

| Registered Service | Paynet's Service(s) that the Merchant is registered |

| Request Submission Date | Date the Registration Request is submitted |

| Requested Go Live Date | The date that the service would go live for the merchant, as request by the merchant |

Footer:

| Field Name | Description |

|---|---|

| Record Type | Value “03” to indicate FOOTER record |

| Total Record Count | Total record count, excluding header and trailer records |

Consent Maintenance File (CMR02)

This file contains all the Consent transactions initiated by the Participant within the day.

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Value “01” to indicate HEADER record | |

| 2 | Report Date | Report Date in yyyyMMdd format. E.g. 20171023 | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | to indicate Registration records | Value “02” |

| 2 | Message ID | Transaction reference set by the OFI | |

| 3 | Business Message ID | Business Message ID from OFI | |

| 4 | OFI Code | BIC Code of OFI | |

| 5 | Maintenance Type | Type of maintenance that was carried out on the Consent

| |

| 6 | Consent ID | ID of consent being maintained | |

| 7 | Merchant ID | Merchant ID tagged | |

| 8 | Product ID | Product ID tagged | |

| 9 | Secondary Id Type | Type of Secondary Id record used | |

| 10 | Secondary Id | Secondary ID being tagged to the consent | Account Detail (Clear Text) |

| 11 | Debtor BIC | Debiting Bank of the consent. | |

| 12 | Account Type | Debiting account type of the consent | |

| 13 | Debiting Account | Debiting account of the consent | Clear Text |

| 14 | Debiting Account Name | Debiting account name | |

| 15 | Consent Amount | Maximum debiting amount | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 16 | Consent Frequency | Consent frequency

| |

| 17 | Consent Expiry | Expiry date of consent | <yyyyMMdd> |

| 18 | Creditor BIC | Crediting Participant of the consent |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Value '03' to indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

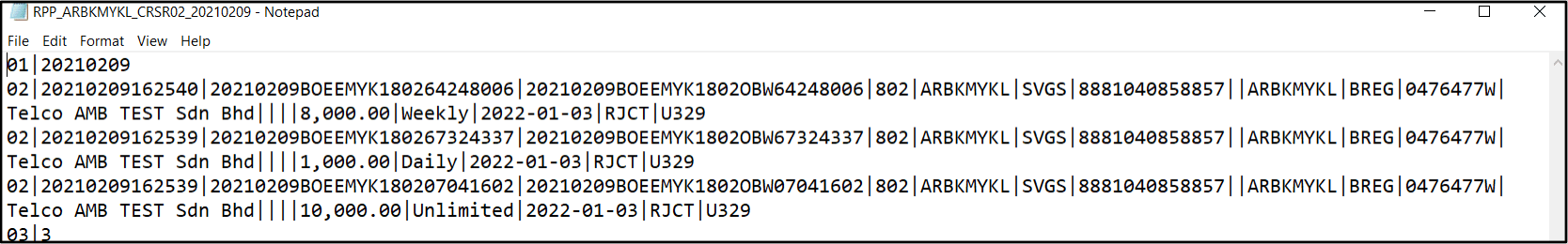

Consent Maintenance File for Direct Debit (CMR04)

This file contains all the Consent transactions initiated by the Participant within the day.

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Value “01” to indicate HEADER record | |

| 2 | Report Date | Report Date in yyyyMMdd format. E.g. 20171023 | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | to indicate Registration records | Value “02” |

| 2 | Message ID | Transaction reference set by the OFI | |

| 3 | Business Message ID | Business Message ID from OFI | |

| 4 | OFI Code | BIC Code of OFI | |

| 5 | Maintenance Type | Type of maintenance that was carried out on the Consent (802) | |

| 6 | Consent ID | ID of consent being maintained | |

| 7 | Merchant ID | Merchant ID tagged | |

| 8 | Product ID | Product ID tagged | |

| 9 | Secondary Id Type | Type of Secondary Id record used | |

| 10 | Secondary Id | Secondary ID being tagged to the consent | Account Detail (Clear Text) |

| 11 | Debtor BIC | Debiting Bank of the consent. | |

| 12 | Account Type | Debiting account type of the consent | |

| 13 | Debiting Account | Debiting account of the consent | Clear Text |

| 14 | Debiting Account Name | Debiting account name | |

| 15 | Consent Amount | Maximum debiting amount | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 16 | Consent Frequency | Consent frequency

| |

| 17 | Consent Expiry | Expiry date of consent | <yyyyMMdd> |

| 18 | Creditor BIC | Crediting Participant of the consent | |

| 19 | Reference ID | Direct Debit Mandate Payment Reference number |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Value "03" to indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

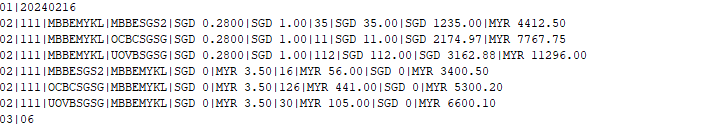

Service Fee for DuitNow Cross Border Fund Transfer (CBSF02)

This file contains the service fee for DuitNow Cross Border Fund Transfer transactions initiated by the Participant within the day.

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Value “01” to indicate HEADER record | Value “01” |

| 2 | Report Date | Report Date in yyyyMMdd format. E.g. 20240216 | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | Record Type | To indicate service fee records | Value “02” | ||||||

| 2 | Service Type | Service type for transaction (111) | |||||||

| 3 | OFI Code | BIC Code of OFI | |||||||

| 4 | RFI Code | BIC Code of RFI | |||||||

| 5 | FX Rate | FX rate value | |||||||

| 6 | Service Fee Charged | Service fee charged value:

*Service fee value will be fixed value | |||||||

| 7 | Transaction Count | Total count of successful transaction | |||||||

| 8 | Total Service Fee | Value of (Service Fee * Transaction Count) | |||||||

| 9 | Total Transaction Value - SGD | Total transaction value in SGD | |||||||

| 10 | Total Transaction Value - MYR | Total transaction value in MYR |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Value "03" to indicate FOOTER record | Value “03” |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

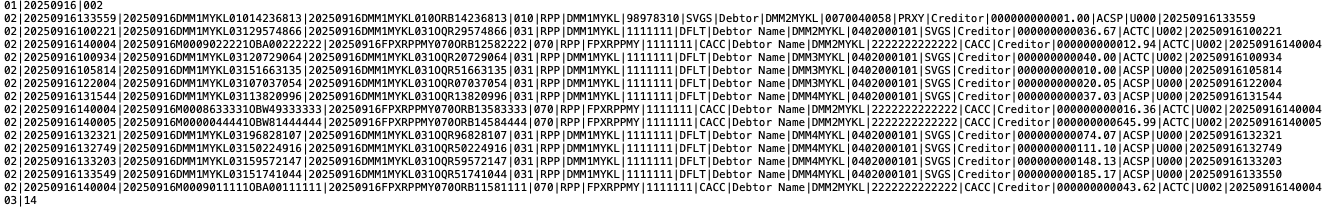

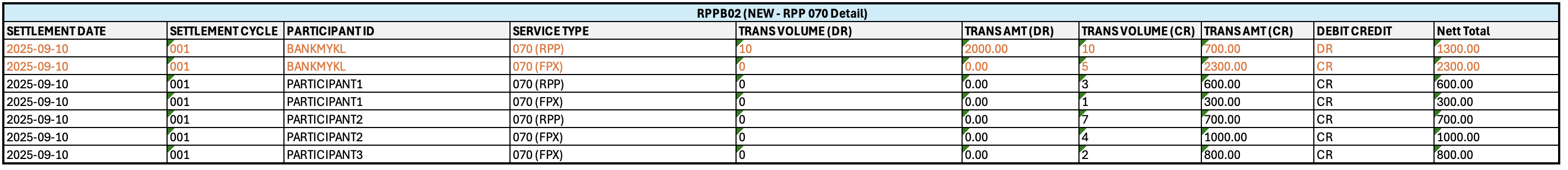

RPP and RPP-FPX Summary Cycle Report (RPPB02)

This Summary Report is generated for each cycle and separates RPP Service 070 into RPP and RPP-FPX transactions.

Fields

| Field | Field Type | Description | Sample Data | |

|---|---|---|---|---|

| 1 | SETTLEMENT DATE | String | Date of when the transaction sent to BNM for settlement | 2025-09-24 |

| 2 | SETTLEMENT CYCLE | String | Identifier of which window transaction was sent to BNM for settlement | '001' or '002' |

| 3 | PARTICIPANT ID | String | BIC Code of the settlement bank and its participants | BANKMYKL |

| 4 | SERVICE TYPE | String | Payment type to show FPX Bridge or RPP transaction | ‘070 (FPX)’ or ‘070 (RPP)’ |

| 5 | TRANS VOLUME (DR) | Integer | Total debit volume of RPP-FPX transaction count | 5000 |

| 6 | TRANS AMT (DR) | Decimal | Total debit value of RPP-FPX transaction | 50000.00 |

| 7 | TRANS VOLUME (CR) | Integer | Total credit volume of RPP-FPX transaction count | 5000 |

| 8 | TRANS AMT (CR) | Decimal | Total credit value of RPP-FPX transaction | 50000.00 |

| 9 | DEBIT CREDIT | String | This is the debit or credit for Nett Total amount | ‘DR’ or ‘CR’ |

| 10 | NETT TOTAL | Decimal | Nett total value of RPP-FPX transaction | 50000.00 |

RPPB02 Sample File

Download sample file

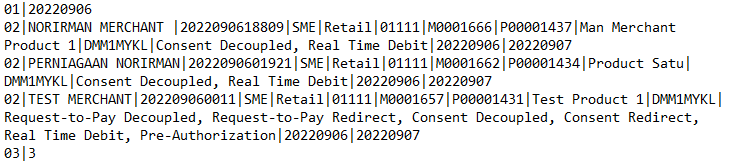

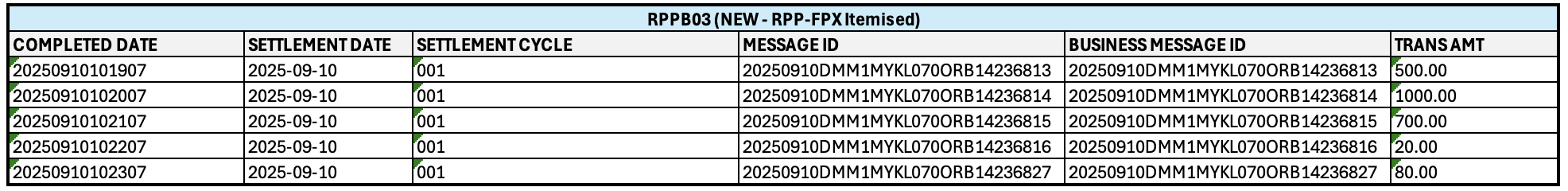

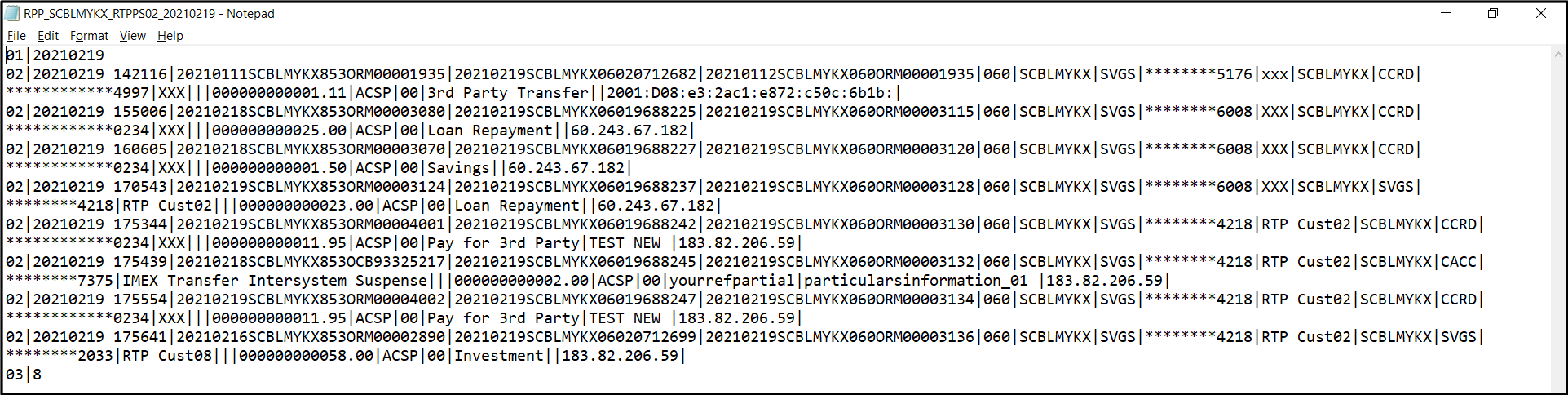

RPP-FPX Itemised Cycle Report (RPPB03)

This is the Itemised Report generated per cycle that contains RPP-FPX Transactions received by the Participants.

Fields

| Field | Field Type | Description | Sample Data | |

|---|---|---|---|---|

| 1 | COMPLETED DATE | String | Date time of when the transaction performed. Format yyyymmddhhmmss | 20250924171907 |

| 2 | SETTLEMENT DATE | String | Date of when the transaction sent to BNM for settlement | 2025-09-24 |

| 3 | SETTLEMENT CYCLE | String | Identifier of which window transaction was sent to BNM for settlement | ‘001’ or ‘002’ |

| 4 | MESSAGE ID | String | Transaction reference set by the Originator bank (OFI) | 20250924M0009022221OBA00222222 |

| 5 | BUSINESS MESSAGE ID | String | Business Message Id from the OFI | 20250924FPXRPPMY070ORB12582222 |

| 6 | TRANS AMT | Decimal | Transaction Amount | 50000.00 |

RPPB03 Sample File

Download sample file

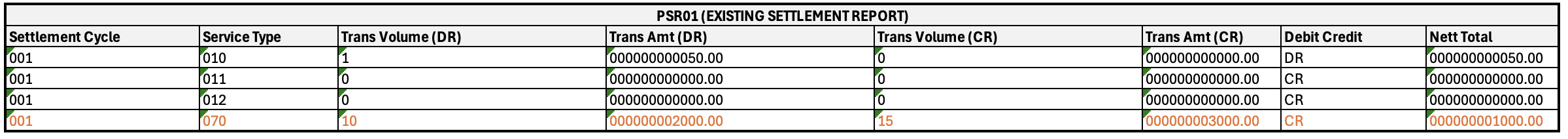

RPP-FPX Transaction Reconciliation Using RPPB02 and RPPB03

The Service Type 070 comprises both RPP and RPP-FPX transactions. As of 30 September 2025, BNM has mandated PayNet for RPP transactions to be settled in RENTAS+ while RPP-FPX transactions remain net settled using RENTAS.

Figure 1: Existing PSR01 Report Sample

To support Settlement Banks of Third Party Acquirers, two new reports are being introduced.

The first, RPPB02, summarises Service Type 070 and segregates totals by RPP OBW (070 RPP) transactions and RPP-FPX (070 FPX) transactions. Additionally, the RPP-FPX transactions of its Non-Bank Participants will be presented in the same report. The total amounts of RPP OBW transactions and RPP-FPX transactions will reconcile with the Service Type 070 figures presented in the PSR01 report.

Figure 2: New RPPB02 Report (*actual report is in CSV format)

The second, RPPB03, provides a detailed listing of all RPP-FPX transactions. The total transaction amount will reconcile with the net total of RPP-FPX transactions for the bank as presented in RPPB02.

Figure 3: New RPPB03 Report (*actual report is in CSV format)

On-Us Report

This is the On-Us report generated by the FI that should contain all the DuitNow transactions that did not trigger through RPP.

Itemised Report

The itemised On-Us report should be submitted before 10AM daily for transactions from the previous day.

Layout

Fields

Header:

| Field Name | Length | Format | |

|---|---|---|---|

| 1 | Record Type | PIC 9 (2) | Value “01” to indicate HEADER record |

| 2 | Report Date | PIC X (8) | Report Generation Date in yyyyMMdd format. E.g. 20171023 |

| 3 | ORI Code | PIC X (8) | Financial institution servicing an account for the debtor/creditor |

Body:

| Field Name | Length | Description | |

|---|---|---|---|

| 1 | Record Type | PIC 9 (2) | Value “02” to indicate Transaction records |

| 2 | Initiation Date | PIC X (14) | Date and time at which the transaction was created (yyyyMMddHHmmss) |

| 3 | Message Id (MsgId) | PIC X (35) | Transaction reference set by the Originator bank (OFI) |

| 4 | Business Message Id (BizMsgId) | PIC X (35) | Business Message Id from the OFI |

| 5 | Service | PIC 9 (3) | Business purpose of the transaction i.e. Credit Transfer, QR transaction, Payment Return etc. (E.g 011 – Reverse Credit Transfer) |

| 6 | Scheme Id(Creditor Bank) | PIC X (8) | Name of the scheme that manages a creditor of the non-participating bank to process their payments. Scheme has a direct relationship with the process |

| 7 | OFI Bank | PIC X (8) | ORI Bank Code |

| 8 | OFI Customer type | PIC X (1) | Individual or Business. R: Retail C: Corporate |

| 9 | OFI Account Number | PIC 9 (34) | Debtor’s Account Number |

| 10 | OFI Account Type | PIC X (4) | Debtor’s Account Type |

| 11 | OFI Account Name | PIC X (140) | Debtor’s Name |

| 12 | RFI Bank | PIC X (8) | RFI Bank Code |

| 13 | RFI Customer Type | PIC X (1) | Individual or Business. R: Retail, C: Corporate |

| 14 | RFI Account Number | PIC 9 (34) | Creditor Account Number For DuitNow QR transactions: to populate the value same as TAR report i.e. QR_ID |

| 15 | RFI Account Type | PIC X (4) | Creditor’s Account Type. Valid value: CACC, LOAN, SVGS, CCRD |

| 16 | RFI Account Name | PIC X (140) | Creditor Name |

| 17 | Transaction Amount | PIC X (15) | Transaction Amount or Reversed Amount. This amount will be presented in 999999999999.99 format. For e.g. RM 1000.00 will be shown as 000000001000.00 |

| 18 | Proxy Type | PIC X (4) | Mobile, NRIC, Army/Police Number, Passport or Business Registration Number. Valid value: NRIC, ARMN, MBNO, BREG, PSPT Note: Applicable only for services that uses NAD Proxy |

| 19 | Proxy Value | PIC X (140) | Variable Note: Applicable only for services that uses NAD Proxy |

| 20 | Proxy Registration ID | PICX (35) | Proxy unique registration id Note: Applicable only for services that uses NAD Proxy |

| 21 | Transaction Status | PIC X (4) | Status of the transaction. Valid value: ACSP, RJCT |

| 22 | Transaction Reason Code | PIC X (4) | Transaction reason code for Transactions under ACCEPTED status(e.g. U000-Success/ Transaction accepted, U110-Payment not accepted, U804-Alias Not Found) |

| 23 | Transfer Channel | PIC X (2) | Mobile / ATM / IB. RM: Retail Mobile Banking, CM: Corporate Mobile Banking, CB: Corporate Internet Banking, RB: Retail Internet Banking, OT: Other |

| 24 | Future Dated Flag | PIC X (1) | To indicate if this is a future dated transaction, Y/N |

| 25 | Completed Date | PIC X (14) | Date and time at which the transaction was completed (yyyyMMddHHmmss) |

| 26 | On-us / Off us | PIC X (2) | To indicate if this is on-us or off-us transaction. 01: On-us 02: Off-us |

Summarised Report

The summarised On-Us report should be submitted before 10AM on the first (1st) day of the following month for the transactions from the previous month.

Layout

Fields

Header:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (2) | Value “01” to indicate HEADER record |

| Report Date | PIC X (8) | Report Generation Date in yyyyMMdd format. E.g. 20171023 |

| ORI Code | PIC X (8) | Financial institution servicing an account for the debtor/creditor |

| Total Record Count | PIC 9 (18) | Total record count, excluding header and trailer records. |

Body:

| Field Name | Length | Description |

|---|---|---|

| Record Type | PIC 9 (2) | Value “02” to indicate Transaction records |

| Transaction Type | PIC X (3) | Type of the transaction. 010 – CT, 110 – DuitNow, 011 – Reversal, 030 – QR Merchant, 040 – QR P2P |

| Transaction Status | PIC X (4) | Status of the transaction. Valid value: ACSP, RJCT |

| Total Transaction Count | PIC 9 (18) | Total transaction count |

| Total Transaction Amount | PIC X (18) | Transaction Amount or Reversed Amount. This amount will be presented in 999999999999999.99 format. For e.g. RM 1000.00 will be shown as 000000000001000.00 |

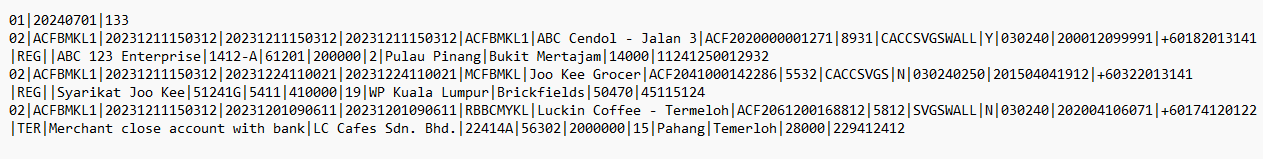

QR Merchant Registration & Termination Report

This is a monthly report to be generated by participants in text format to inform PayNet on the details of QR Merchant registered and terminated with the participant.

Participants are required to submit the report before 10:00 AM on the first (1st) day of the following month containing information of successfully registered / terminated merchants occurred in the preceding month.

Should there be any revision to the information previously submitted, participants are to resubmit the merchant's information in the succeeding submission.

Layout:

Fields:

Header:

| Field Name | Description | Format | Mandatory/Optional | |

|---|---|---|---|---|

| 1 | Record Type | Value “01” to indicate HEADER record | Value "01", Numeric (2) | Mandatory |

| 2 | Report Date | Report Date in yyyyMMdd format. E.g. 20171023 | yyyyMMdd, Numeric (8) | Mandatory |

| 3 | Total Record Count | Total record count, excluding header and trailer records. | Numeric | Mandatory |

Body:

| Field Name | Description | Format & Length | Mandatory/Optional | Valid Values | ||

|---|---|---|---|---|---|---|

| 1 | Record Type | Value “02” to indicate Registration records | Numeric (2) | Mandatory | 02 | |

| 2 | Acquirer Participant | Acquirer Participant’s BIC Code | AlphaNumeric (8) | Mandatory | ||

| 3 | Registration Date | Date and time at which the Merchant registration was submitted | yyyyMMddHHmmss, Numeric (14) | Mandatory | ||

| 4 | Approval Date | Date and time at which the Merchant registration was approved. If not applicable, to be the same as Registration date. | yyyyMMddHHmmss, Numeric (14) | Mandatory | ||

| 5 | Effective Date | Date and time at which the Merchant start receiving payments via DuitNow QR. If not applicable, to be the same as Approval date. | yyyyMMddHHmmss, Numeric (14) | Mandatory | ||

| 6 | Collection Account Participant (Settlemen Bank) | BIC Code where merchant collection account is maintained. If same as Acquirer Participant, use Acquirer Participant BIC Code. | AlphaNumeric (8) | Mandatory | ||

| 7 | Merchant Name | Merchant Company Name. This should be same as in the QR Code. | AlphaNumeric Symbol (Var. up to 25) | Mandatory | ||

| 8 | QR ID | Merchant QR ID. This should be same as in the QR Code. | AlphaNumeric (28) | Mandatory | Kindly ensure value is consistent with QR ID in transaction | |

| 9 | Merchant Category Code (MCC) | Defined by ISO18245. This should be same as in the QR Code. | Numeric (4). Please refer to list of valid values | Mandatory | Please refer to the list of valid MCC here | |

| 10 | Merchant Acceptable Source of Fund | Merchant acceptable source of fund | Alphabet (20) | Mandatory | CACC, SVGS, CCRD, WALL | |

| 11 | Dynamic QR | Dynamic QR Status | Alphabet (1) | Mandatory | Y/N | |

| 12 | Services Subscribed | Services that Merchant will be using. | AlphaNumeric (50) | Mandatory | 030, 240, 250, 032. for details, please refer to RPP Transaction Codes | |

| 13 | Business Registration Number | Merchant’s business registration number.

| AlphaNumeric (30) | Mandatory | ||

| 14 | Mobile Number | Merchant’s mobile number. Please include country code. (+60.....) | AlphaNumeric (15) with country code | Mandatory | ||

| 15 | Status | Status of Merchant. REG (Registration), TER (Termination) | Alphabet (3) | Mandatory | REG or TER | |

| 16 | Reason | Only applicable if Status = TER. Reason description for terminated merchant | Freeform (150) | Conditional | ||

| 17 | Merchant registered legal entity name | Registered full name of the merchant entity. If the merchant is an individual / sole proprietor, please provide full name of the Business owner | AlphaNumeric (100) | Mandatory | ||

| 18 | Old Business Registration Number (BRN) | Applicable for SSM registered merchants: Old Business Registration Number e.g. 836743-D if ‘Business Registration Number’ field is populated with old BRN value, participant should populate New BRN e.g. 200801035403 into the Business Registration Number field | AlphaNumeric (15) | Conditional | ||

| 19 | MSIC Sector code | Sector of merchant business according to 5-digit Malaysia Standard Industrial Classification (MSIC) 2008 code | Numeric (5) | Mandatory | Please refer to the list of valid MSIC 2008 Codes here | |

| 20 | Annual Sales Turnover | Merchant’s annual sales turnover in Ringgit Malaysia. For company size / MSME visibility. E.g. 500000, 2230000 | Numeric (15) | Optional | ||

| 21 | Number of full-time employees | Merchant’s number of full-time employee. For company size / MSME visibility.e.g 50, 122. | Numeric (6) | Optional | ||

| 22 | Merchant Business Size | Merchant's Business/Company Size according to sector, full-time employee & sales turnover per SSM definition | Alphabet (6) | Mandatory | Please refer to the list of valid Business Size here | |

| 23 | Merchant State | State of Merchant’s outlet location where QR is used | AlphaNumeric (50) | Mandatory | Please refer to list of valid State values here | |

| 24 | Merchant District | District of Merchant’s outlet location where QR is used | AlphaNumeric (50) | Mandatory | Please refer to list of valid District values here | |

| 25 | Merchant Postcode | Postcode of Merchant’s outlet location where QR is used | Numeric (5 digit) | Mandatory | Please refer to list of valid Postcode values here | |

| 26 | Settlement Account Number | Merchant’s crediting account number with the Collection Account Participant (settlement bank). This is different from QR_ID. | AlphaNumeric (30) | Mandatory |

Please refer to here for the following fields

- Merchant Category Code (MCC)

- MSIC Sector code

- Merchant Business Size

- Merchant State

- Merchant District

- Merchant Postcode

FI Server Paths

| Description | Path |

|---|---|

This is where Participants upload the reports, e.g.:

| SIT: <BICCODE>/RPP/<mmm>/inbound_sit/onus/<report or file name> UAT: <BICCODE>/RPP/<mmm>/inbound_uat/onus/<report or file name> PROD: <BICCODE>/RPP/<mmm>/inbound/onus/<report or file name> |

This is where Participants upload the batch files, e.g.:

| SIT: <BICCODE>/RPP/<mmm>/inbound_sit/batchfile/<report or file name> UAT: <BICCODE>/RPP/<mmm>/inbound_uat/batchfile/<report or file name> PROD: <BICCODE>/RPP/<mmm>/inbound/batchfile/<report or file name> |

This is where Participants upload the QR Merchant Registration report | SIT: <BICCODE>/RPP/<mmm>/inbound_sit/QR_reg/<report or file name> UAT: <BICCODE>/RPP/<mmm>/inbound_uat/QR_reg/<report or file name> PROD: <BICCODE>/RPP/<mmm>/inbound/QR_reg/<report or file name> |

This is where Participants download the phase-1 reports from RPP, e.g.:

| SIT: <BICCODE>/RPP/<mmm>/outbound_sit/<yy-mm-dd>/<report or file name> UAT: <BICCODE>/RPP/<mmm>/outbound_uat/<yy-mm-dd>/<report or file name> PROD: <BICCODE>/RPP/<mmm>/outbound/<yy-mm-dd>/<report or file name> |

This is where Participants download the reports from RPP, e.g.:

| SIT: <BICCODE>/RPP/<mmm>/outbound_p2_sit/<yy-mm-dd>/<report or file name> UAT: <BICCODE>/RPP/<mmm>/outbound_p2_uat/<yy-mm-dd>/<report or file name> PROD: <BICCODE>/RPP/<mmm>/outbound/<yy-mm-dd>/<report or file name> |

This is where Participants download the batch file results, e.g.:

| SIT: <BICCODE>/RPP/<mmm>/outbound_sit/batchfile_return/<report or file name> UAT: <BICCODE>/RPP/<mmm>/outbound_uat/batchfile_return/<report or file name> PROD: <BICCODE>/RPP/<mmm>/outbound/batchfile_return/<report or file name> |

Request-to-Pay SAF Successful File (RTPSS02)

This file contains request-to-pay that were successfully accepted by the RFI during the store and forward process.

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER record | Value "01" |

| 2 | Report Date | Date the Report generated for | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" |

| 2 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> |

| 3 | Message Id | Transaction reference set by the Originator bank (OFI) | |

| 4 | Business Message Id | Business Message Id from the OFI | |

| 5 | Service Type | Business purpose of the transaction i.e.:

| |

| 6 | Dr Part. | Financial institution servicing an account for the debtor | |

| 7 | Acct Type | Debtor’s Account Type | |

| 8 | Payer Acct | Debtor’s Account Number | Account No. is masked, only last 4 digits is displayed |

| 9 | Acct Name | Debtor’s Name | |

| 10 | Cr Part. | Financial institution servicing an account for the creditor | |

| 11 | Acct Type | Creditor’s Account Type | |

| 12 | Recipient Acct | Creditor’s Account Number | Account No. is masked, only last 4 digits is displayed |

| 13 | Acct Name | Creditor’s Name | |

| 14 | RFI Proxy Type | Debtor’s proxy type | |

| 15 | RFI Proxy ID | Debtor’s proxy value | |

| 16 | RFI Proxy Registration ID | Debtor’s proxy registration ID | |

| 17 | Original RFI Account Id | Original Debtor’s Account Number | |

| 18 | Original RFI Proxy Type | Original Debtor’s proxy type | |

| 19 | Original RFI Proxy ID | Original Debtor’s proxy value | |

| 20 | Original RFI Name | Original Debtor’s Name | |

| 21 | Merchant ID | Merchant ID tagged | |

| 22 | Product ID | Product ID tagged | |

| 23 | Transaction Amount | Transaction Amount or Reversed Amount. | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 24 | Status | Transaction Status Code | |

| 25 | Status Reason | Transaction Status Reason Code | |

| 26 | Payment Ref-1 | Payment reference-1 | |

| 27 | Payment Ref-2 | Payment reference-2 | |

| 28 | IP Address | IP Address where request was initiated | |

| 29 | GPS Coordinate | Latitude and longitude where the request initiated | |

| 30 | TX ID | TX ID of the Request-to-Pay request message | |

| 31 | End to End ID | End to End ID of the Request-to-Pay request message |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

Request-to-Pay SAF Rejected File (RTPSR02)

This file contains request-to-pay that were rejected by the RFI during the store and forward process.

Scenario: Creditor sent the Request-to-Pay and accepted by RPP, however the Request-to-Pay message was rejected by Debiting Agent (not Debtor).

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER record | Value "01" |

| 2 | Report Date | Date the Report generated for | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" |

| 2 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> |

| 3 | Message Id | Transaction reference set by the Originator bank (OFI) | |

| 4 | Business Message Id | Business Message Id from the OFI | |

| 5 | Service Type | Business purpose of the transaction i.e.:

| |

| 6 | Dr Part. | Financial institution servicing an account for the debtor | |

| 7 | Acct Type | Debtor’s Account Type | |

| 8 | Payer Acct | Debtor’s Account Number | Account No. in clear text |

| 9 | Acct Name | Debtor’s Name | |

| 10 | Cr Part. | Financial institution servicing an account for the creditor | |

| 11 | Acct Type | Creditor’s Account Type | |

| 12 | Recipient Acct | Creditor’s Account Number | Account No. in clear text |

| 13 | Acct Name | Creditor’s Name | |

| 14 | RFI Proxy Type | Debtor’s proxy type | |

| 15 | RFI Proxy ID | Debtor’s proxy value | |

| 16 | RFI Proxy Registration ID | Debtor’s proxy registration ID | |

| 17 | Original RFI Account Id | Original Debtor’s Account Number | |

| 18 | Original RFI Proxy Type | Original Debtor’s proxy type | |

| 19 | Original RFI Proxy ID | Original Debtor’s proxy value | |

| 20 | Original RFI Name | Original Debtor’s Name | |

| 21 | Merchant ID | Merchant ID tagged | |

| 22 | Product ID | Product ID tagged | |

| 23 | Transaction Amount | Transaction Amount or Reversed Amount. | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 24 | Status | Transaction Status Code | |

| 25 | Status Reason | Transaction Status Reason Code | |

| 26 | Payment Ref-1 | Payment reference-1 | |

| 27 | Payment Ref-2 | Payment reference-2 | |

| 28 | IP Address | IP Address where request was initiated | |

| 29 | GPS Coordinate | Latitude and longitude where the request initiated | |

| 30 | TX ID | TX ID of the Request-to-Pay request message | |

| 31 | End to End ID | End to End ID of the Request-to-Pay request message |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

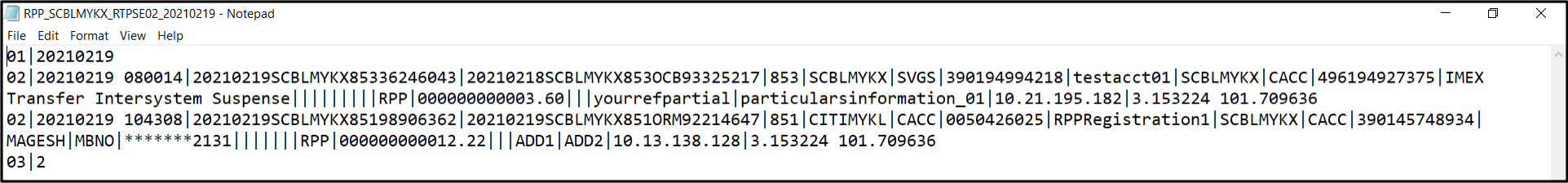

Request-to-Pay SAF Exception File (RTPSE02)

This file contains request-to-pay that no response were received from RFI during the store and forward process.

Scenario: Creditor sent the Request-to-Pay and accepted by RPP, however no response received when RPP send the Request-to-Pay to Debiting Agent (not Debtor)

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER record | Value "01" |

| 2 | Report Date | Date the Report generated for | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" |

| 2 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> |

| 3 | Message Id | Transaction reference set by the Originator bank (OFI) | |

| 4 | Business Message Id | Business Message Id from the OFI | |

| 5 | Service Type | Business purpose of the transaction i.e.:

| |

| 6 | Dr Part. | Financial institution servicing an account for the debtor | |

| 7 | Acct Type | Debtor’s Account Type | |

| 8 | Payer Acct | Debtor’s Account Number | Account No. in clear text |

| 9 | Acct Name | Debtor’s Name | |

| 10 | Cr Part. | Financial institution servicing an account for the creditor | |

| 11 | Acct Type | Creditor’s Account Type | |

| 12 | Recipient Acct | Creditor’s Account Number | Account No. in clear text |

| 13 | Acct Name | Creditor’s Name | |

| 14 | RFI Proxy Type | Debtor’s proxy type | |

| 15 | RFI Proxy ID | Debtor’s proxy value | |

| 16 | RFI Proxy Registration ID | Debtor’s proxy registration ID | Proxy ID is masked, only last 4 digits is displayed |

| 17 | Original RFI Account Id | Original Debtor’s Account Number | |

| 18 | Original RFI Proxy Type | Original Debtor’s proxy type | |

| 19 | Original RFI Proxy ID | Original Debtor’s proxy value | |

| 20 | Original RFI Name | Original Debtor’s Name | |

| 21 | Merchant ID | Merchant ID tagged | |

| 22 | Product ID | Product ID tagged | |

| 23 | Transaction Amount | Transaction Amount or Reversed Amount. | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 24 | Status | Transaction Status Code | |

| 25 | Status Reason | Transaction Status Reason Code | |

| 26 | Payment Ref-1 | Payment reference-1 | |

| 27 | Payment Ref-2 | Payment reference-2 | |

| 28 | IP Address | IP Address where request was initiated | |

| 29 | GPS Coordinate | Latitude and longitude where the request initiated | |

| 30 | TX ID | TX ID of the Request-to-Pay request message | |

| 31 | End to End ID | End to End ID of the Request-to-Pay request message |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

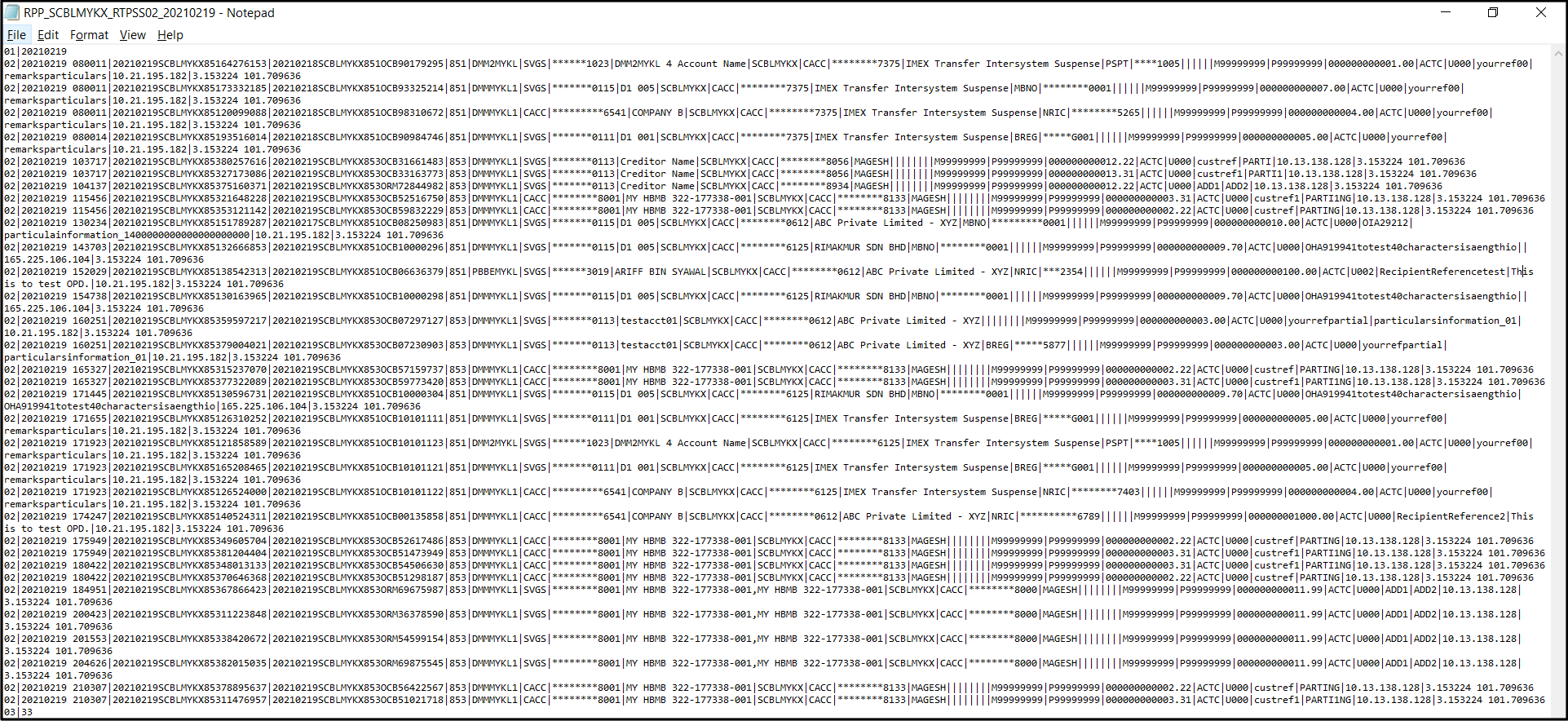

Request-to-Pay Payment Successful File (RTPPS02)

This file contains request-to-pay payments that were successfully accepted by the RFI during the store and forward process.

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER record | Value "01" |

| 2 | Report Date | Date the Report generated for | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" |

| 2 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> |

| 3 | Message Id | Transaction reference set by the Originator bank (OFI) | |

| 4 | Business Message Id | Business Message Id from the OFI | |

| 5 | Service Type | Business purpose of the transaction i.e.:

| |

| 6 | Dr Part. | Financial institution servicing an account for the debtor | |

| 7 | Acct Type | Debtor’s Account Type | |

| 8 | Payer Acct | Debtor’s Account Number | Account No. is masked, only last 4 digits is displayed |

| 9 | Acct Name | Debtor’s Name | |

| 10 | Cr Part. | Financial institution servicing an account for the creditor | |

| 11 | Acct Type | Creditor’s Account Type | |

| 12 | Recipient Acct | Creditor’s Account Number | Account No. is masked, only last 4 digits is displayed |

| 13 | Acct Name | Creditor’s Name | |

| 14 | Merchant ID | Merchant ID tagged | |

| 15 | Product ID | Product ID tagged | |

| 16 | Transaction Amount | Transaction Amount or Reversed Amount. | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 17 | Status | Transaction Status Code | |

| 18 | Status Reason | Transaction Status Reason Code | |

| 19 | Payment Ref-1 | Payment reference-1 | |

| 20 | Payment Ref-2 | Payment reference-2 | |

| 21 | IP Address | IP Address where request was initiated | |

| 22 | GPS Coordinate | Latitude and longitude where the request initiated | |

| 23 | TX ID | TX ID of the Payment Request message | |

| 24 | End to End ID | End to End ID of the Payment Request message |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

Request-to-Pay Payment Rejected File (RTPPR02)

This file contains request-to-pay payments that were rejected by the RFI during the store and forward process.

Scenario: Payer authorized the payment request to pay, however the Credit Transfer was rejected by Crediting Agent

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER record | Value "01" |

| 2 | Report Date | Date the Report generated for | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" |

| 2 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> |

| 3 | Message Id | Transaction reference set by the Originator bank (OFI) | |

| 4 | Business Message Id | Business Message Id from the OFI | |

| 5 | Service Type | Business purpose of the transaction i.e.:

| |

| 6 | Dr Part. | Financial institution servicing an account for the debtor | |

| 7 | Acct Type | Debtor’s Account Type | |

| 8 | Payer Acct | Debtor’s Account Number | Account No. in clear text |

| 9 | Acct Name | Debtor’s Name | |

| 10 | Cr Part. | Financial institution servicing an account for the creditor | |

| 11 | Acct Type | Creditor’s Account Type | |

| 12 | Recipient Acct | Creditor’s Account Number | Account No. in clear text |

| 13 | Acct Name | Creditor’s Name | |

| 14 | Merchant ID | Merchant ID tagged | |

| 15 | Product ID | Product ID tagged | |

| 16 | Transaction Amount | Transaction Amount or Reversed Amount. | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 17 | Status | Transaction Status | |

| 18 | Status Reason | Transaction Status Reason | |

| 19 | Payment Ref-1 | Payment reference-1 | |

| 20 | Payment Ref-2 | Payment reference-2 | |

| 21 | IP Address | IP Address where request was initiated | |

| 22 | GPS Coordinate | Latitude and longitude where the request initiated | |

| 23 | TX ID | TX ID of the Request-to-Pay request message | |

| 24 | End to End ID | End to End ID of the Request-to-Pay request message |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

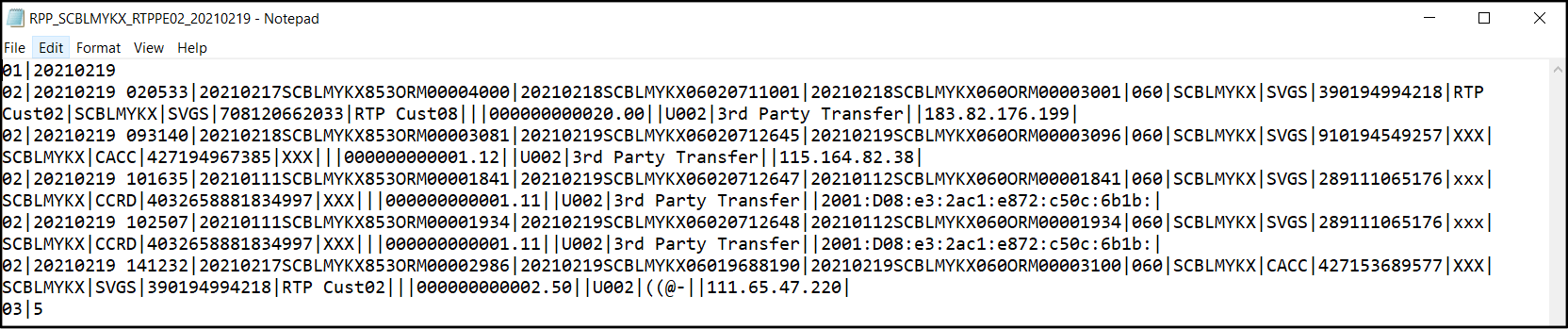

Request-to-Pay Payment Exception File (RTPPE02)

This file contains request-to-pay payments that no response was received from RFI during the store and forward process.

Scenario: Payer authorized the payment request to pay, however the no response received from Crediting Agent during Credit Transfer request

Layout:

Fields:

Header:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate HEADER record | Value "01" |

| 2 | Report Date | Date the Report generated for | <yyyyMMdd> |

Body:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate Transaction records | Value "02" |

| 2 | Initiation Date | Date and time at which the transaction was created | <yyyymmddhhmmss> |

| 3 | Message Id | Transaction reference set by the Originator bank (OFI) | |

| 4 | Business Message Id | Business Message Id from the OFI | |

| 5 | Service Type | Business purpose of the transaction i.e.:

| |

| 6 | Dr Part. | Financial institution servicing an account for the debtor | |

| 7 | Acct Type | Debtor’s Account Type | |

| 8 | Payer Acct | Debtor’s Account Number | Account No. in clear text |

| 9 | Acct Name | Debtor’s Name | |

| 10 | Cr Part. | Financial institution servicing an account for the creditor | |

| 11 | Acct Type | Creditor’s Account Type | |

| 12 | Recipient Acct | Creditor’s Account Number | Account No. in clear text |

| 13 | Acct Name | Creditor’s Name | |

| 14 | Merchant ID | Merchant ID tagged | |

| 15 | Product ID | Product ID tagged | |

| 16 | Transaction Amount | Transaction Amount or Reversed Amount. | Presented in 999999999999.99 format. Eg: RM 1000.00 will be shown as 000000001000.00 |

| 17 | Status | Transaction Status | |

| 18 | Status Reason | Transaction Status Reason | |

| 19 | Payment Ref-1 | Payment reference-1 | |

| 20 | Payment Ref-2 | Payment reference-2 | |

| 21 | IP Address | IP Address where request was initiated | |

| 22 | GPS Coordinate | Latitude and longitude where the request initiated | |

| 23 | TX ID | TX ID of the Request-to-Pay request message | |

| 24 | End to End ID | End to End ID of the Request-to-Pay request message |

Footer:

| Column | Field Name | Description | Format |

|---|---|---|---|

| 1 | Record Type | Indicate FOOTER record | |

| 2 | Total Record Count | Total record count, excluding header and trailer records |

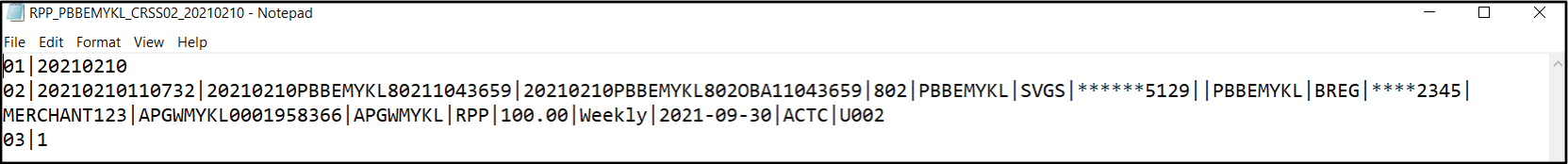

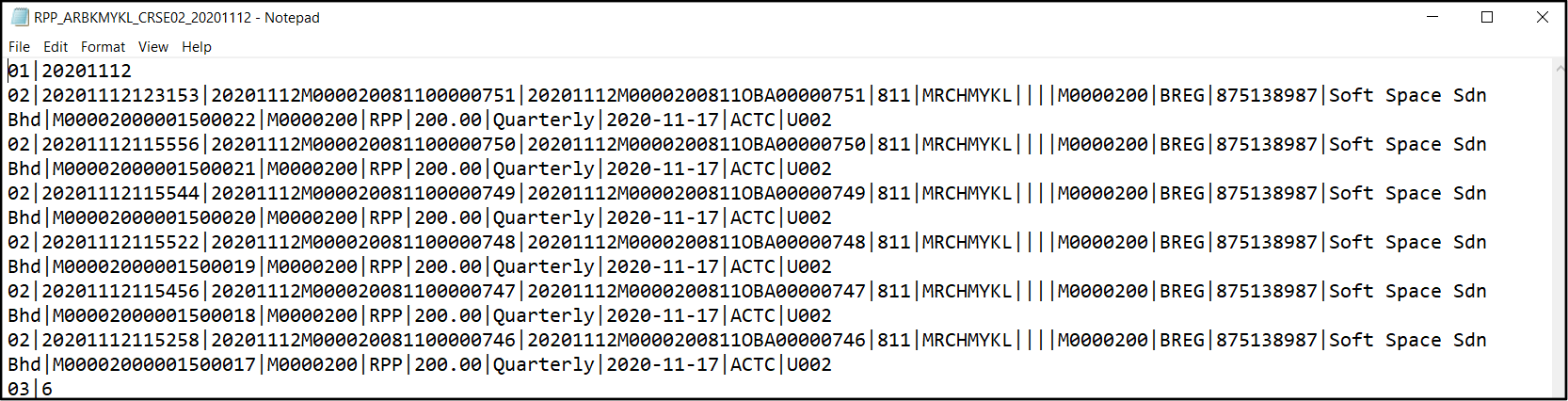

Consent Registration SAF Successful File (CRSS02)

This file contains consent registration requests that were successfully accepted by the RFI during the store and forward process.

Layout:

Fields: