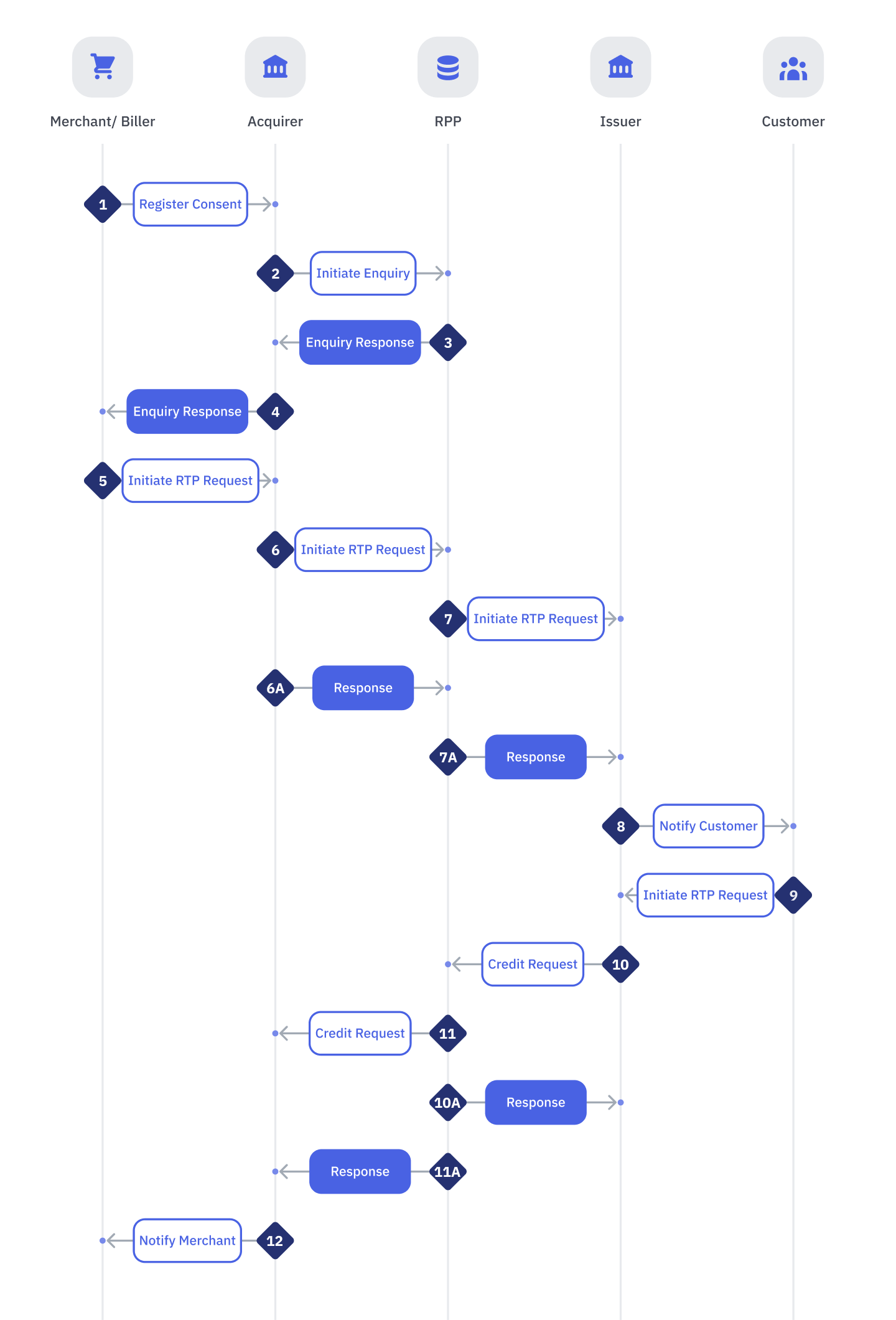

Overview

Successful End-to-End Flow

Successful Proxy Enquiry Flow (Steps 1-4)

Successful Account Enquiry Flow (Steps 1-4)

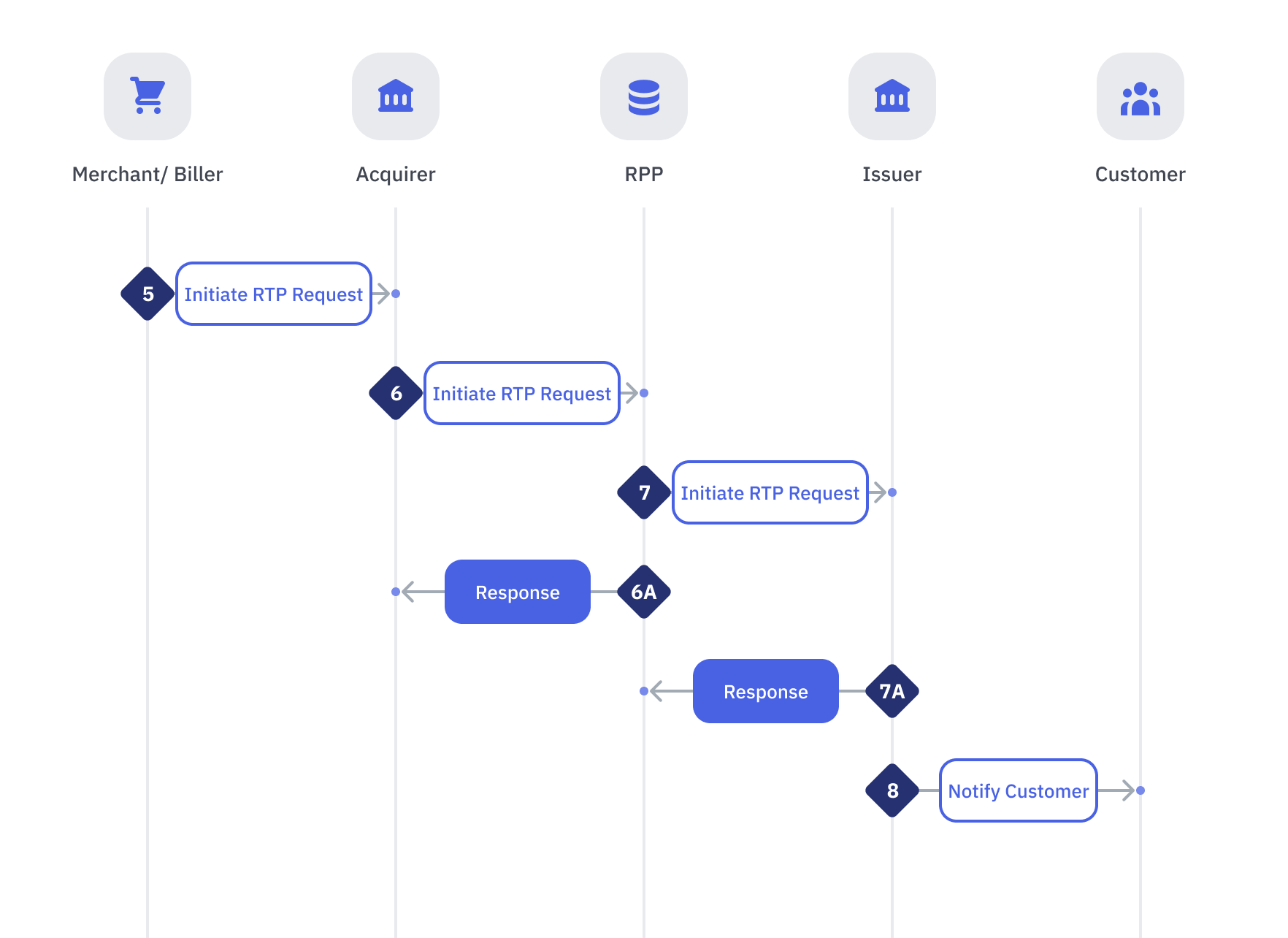

Successful Request-to-Pay DuitNow Request (Steps 5-8)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 5 | Merchant | Acquirer | Merchant confirms proxy information and proceeds to send Request-to-Pay request via Acquirer’s Mobile App/Internet Banking portal. Note:

|

| 6 | Acquirer | RPP | Acquirer will perform the following:

Note:

|

| 6A | RPP | Acquirer | RPP performs the following

If any Message Validation fails, RPP will

If any Business Validation fails, RPP will

If all validations are successful, RPP will

Note:

|

| 7 | RPP | Issuer | RPP performs the following

Note:

|

| 7A | Issuer | RPP | Issuer performs the following

If any Message Validation fails, Issuer will

If any Business Validation fails, Issuer will

If all validations are successful, Issuer will

Note:

|

| 8 | Issuer | Customer | Issuer sends notification and authorization request to Customer about Request-to-Pay request |

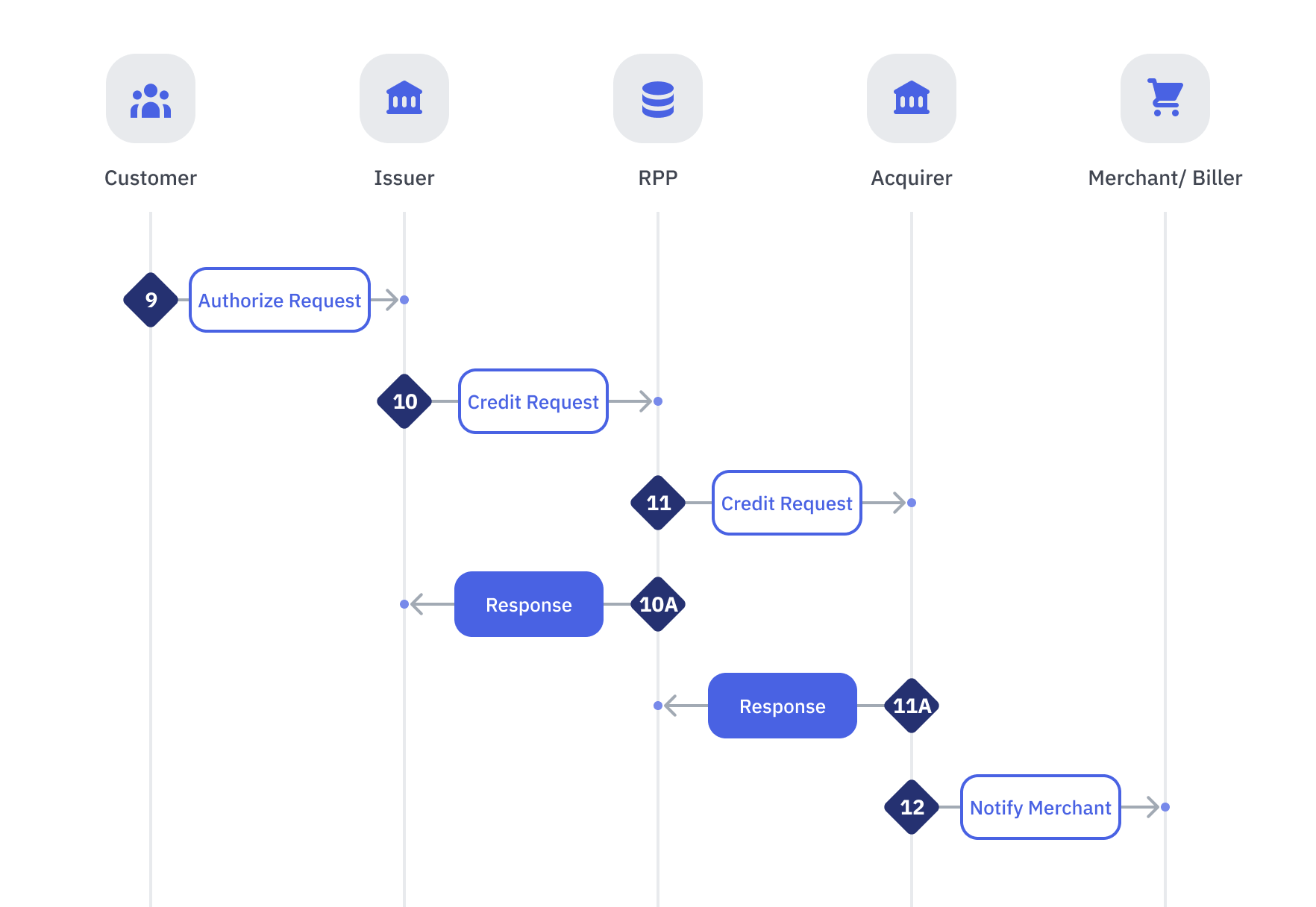

Successful Credit Transfer Flow (Steps 9-12)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 9 | Customer | Issuer | Customer receives notification of Request-to-Pay and authorization request. Customer confirms authorization

|

| 10 | Issuer | RPP | Issuer performs the following:

If all validations are successful, Issuer will

Note:

|

| 10A | RPP | Issuer | RPP performs the following:

If any Message Validation fails, RPP will

If any Business Validation fails, RPP will

If all validations are successful, RPP will

Note:

|

| 11 | RPP | Acquirer | RPP performs the following

Note:

|

| 11A | Acquirer | RPP | Acquirer performs the following:

If any Message Validation fails, Acquirer will

If all validations are successful, Acquirer will

Note:

|

| 12 | Acquirer | Merchant | Acquirer informs Merchant of successful Credit Transfer |

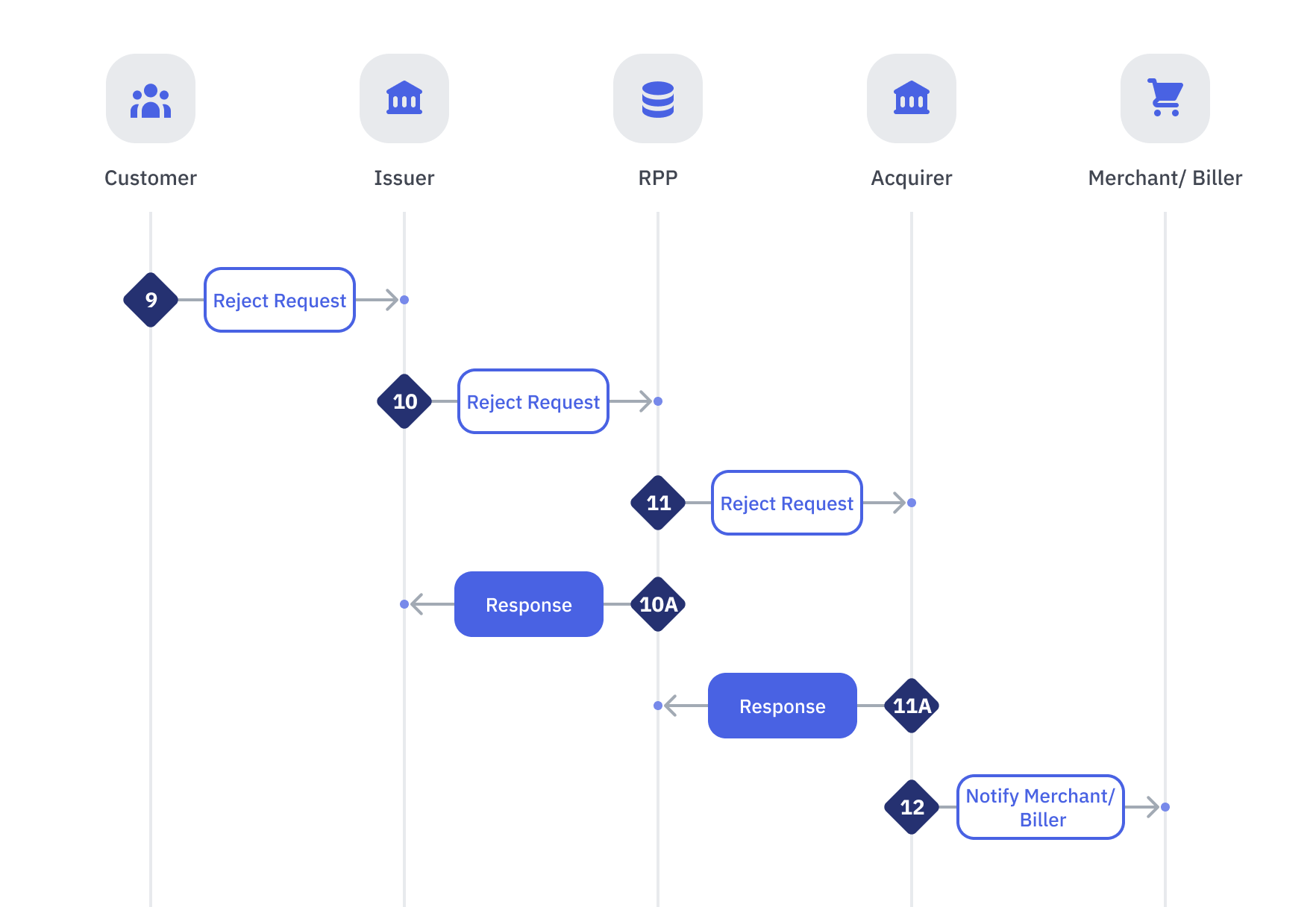

Successful Rejection Flow (Steps 9-12)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 9 | Customer | Issuer | Customer receives notification of Request-to-Pay and authorization request. Customer rejects the request.

Note:

|

| 10 | Issuer | RPP | Issuer performs the following:

If all validations are successful, Issuer will

Note:

|

| 10A | RPP | Issuer | RPP performs the following:

If any Message Validation fails, RPP will

If any Business Validation fails, RPP will

If all validation are successful, RPP will

Note:

|

| 11 | RPP | Acquirer | RPP performs the following

Note:

|

| 11A | Acquirer | RPP | Acquirer performs the following:

If any Message Validation fails, Crediting will

If all validation is successful, Acquirer will

Note:

|

| 12 | Acquirer | Merchant | Acquirer informs Merchant of the rejected Request-to-Pay. |