Initiate Payment Intent (One-Time Payment)

This API end point is to allow acquirer to facilitate one-time payment via DuitNow Online Banking/Wallets transaction with user authentication in their respective bank for debiting request.

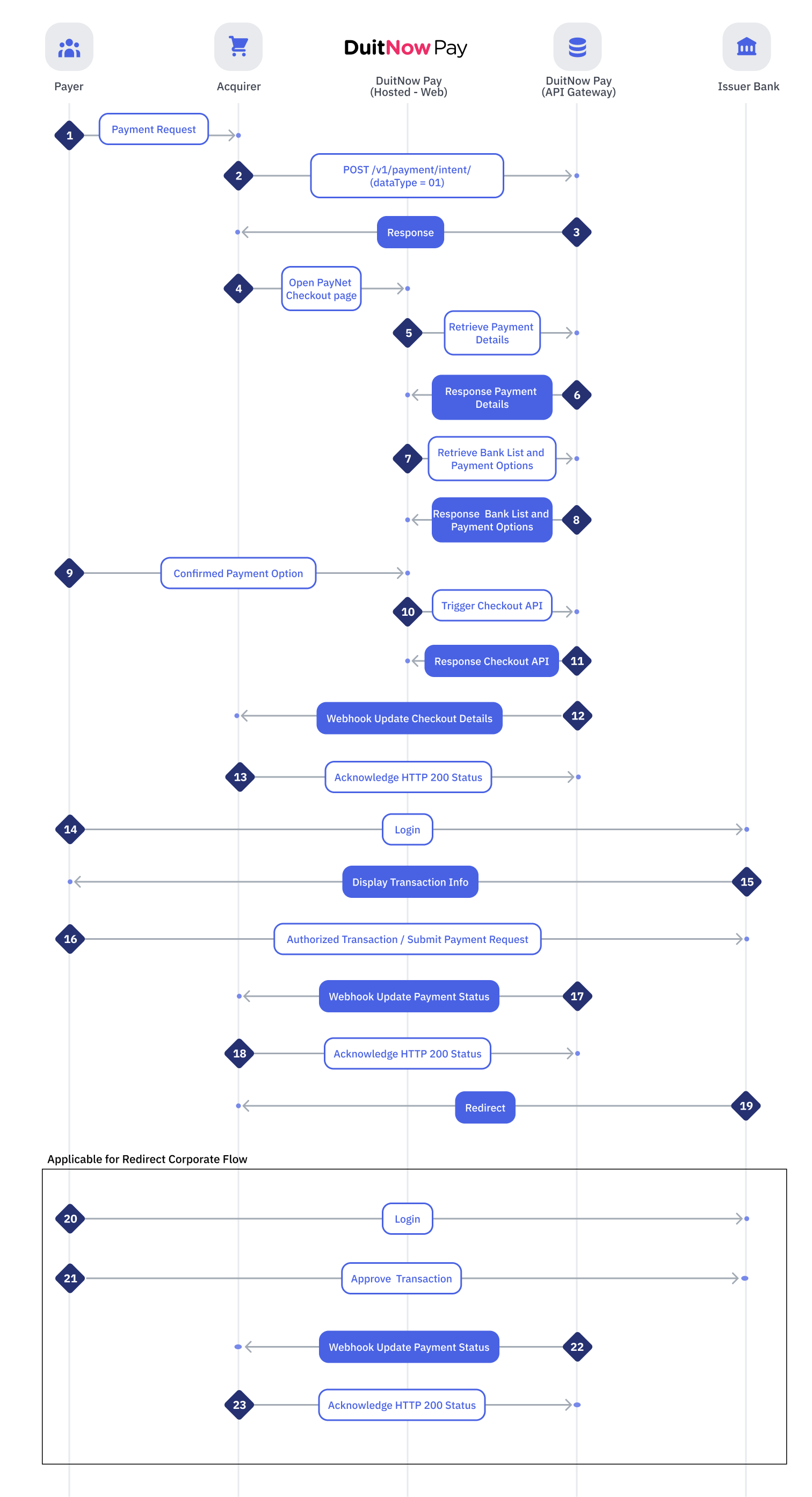

Process Flow

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | Payer | Acquirer | Payer initiates a payment via DuitNow Pay. |

| 2 | Acquirer | API Gateway | Acquirer triggers payment request by parsing required information into API Gateway. For one-time payment, dataType shall be passed with the value of “01”. |

| 3 | API Gateway | Acquirer | API Gateway validated the information and response back the redirectUrl with the sessionId to acquirer with the required information. |

| 4 | Acquirer | DuitNow Pay | Acquirer opens the redirectUrl to load DuitNow Pay. |

| 5 | DuitNow Pay | API Gateway | DuitNow Pay will request the payment details from API Gateway to display the payment information. |

| 6 | API Gateway | DuitNow Pay | API Gateway responded the payment information back to DuitNow Pay. |

| 7 | DuitNow Pay | API Gateway | DuitNow Pay request API Gateway to pull the available banks and payment methods. |

| 8 | API Gateway | DuitNow Pay | The bank list and available payment methods will be parsing back to DuitNow Pay for user to select their preferred payment method. |

| 9 | Payer | DuitNow Pay | Payer will select their preferred Online Banking / Wallet (OBW) method and proceed to confirm checkout. |

| 10 | DuitNow Pay | API Gateway | DuitNow Pay will trigger internal checkout API which initiating OBW payment. |

| 11 | API Gateway | DuitNow Pay | API Gateway will be sending acknowledgement to DuitNow Pay with the redirect for the respective bank for authorization. |

| 12 | API Gateway | Acquirer | API Gateway will be sending the mapping of checkout details back to acquirer. |

| 13 | Acquirer | API Gateway | Acquirer shall provide an acknowledgement back to API Gateway. |

| 14 | Payer | Issuing Bank | Payer will login with the bank credentials to make payments. |

| 15 | Issuing Bank | Payer | Bank will provide the checkout details to the payer. |

| 16 | Payer | Issuing Bank | For Redirect Retail flow, payer will authorize the transaction upon verifying the transaction details. For Redirect Corporate flow, payer will submit transaction request for authorizer approval. |

| 17 | API Gateway | Acquirer | Payment status will be parsed to acquirer as part of the webhook. |

| 18 | Acquirer | API Gateway | Acquirer shall provide an acknowledgement back to API Gateway. |

| 19 | Issuing Bank | Acquirer | Issuing Bank will redirect back to acquirer from the redirect URL that configured during the onboarding process. |

| 20 | Payer | Issuing Bank | Payer as authorizer will login into the corporate bank. |

| 21 | Payer | Issuing Bank | Payer will authorize the transaction upon verifying the transaction details. |

| 22 | API Gateway | Acquirer | Payment status will be parsed to acquirer as part of the webhook. |

| 23 | Acquirer | API Gateway | Acquirer shall provide an acknowledgement back to API Gateway. |

Send the payment intent request

POST /v1/payment/intent

Request

| dataType | String | Max length: 2 | Required | |||

| Service that a user would like to initiate: 01 - Payment (redirect to checkout WebView) 02 - Save payment method (redirect to save payment method WebView) ** Use 01 for for the intention of one-time payment via DuitNow Online Banking/Wallets. | ||||||

| transactionFlow | String | Max length: 2 | Optional | |||

| This decides which list of banks shall be listed, retail or corporate bank. 01 - Redirect Retail Flow 02 - Redirect Corporate Flow ** It will default to 01 if this field has not parsed. ** Checker shall approve the payment within 5 days (starting from the time when it initiated). ** This field is only applicable when the dataType=01. | ||||||

| checkoutId | String | Max length: 36 | Required | |||

| The unique external identifier (uuid v4) provided by the acquirer to PayNet when initiating a payment intent. | ||||||

| sourceOfFunds | ArrayList | Max length: N/A | Optional | |||

| Acceptable source of funds by Merchant. 01 – CASA 02 – Credit Card (not supported at the moment) 03 – eWallet (not supported at the moment) | ||||||

| amount | String | Max length: 18 | Required | |||

| Amount in MYR for the transaction in two decimals (e.g., 10.00). | ||||||

| merchantName | String | Max length: 100 | Optional | |||

| Name of merchant. To be shown to the user in the checkout WebView page. | ||||||

| merchantReferenceId | String | Max length: 140 | Required | |||

| Payment reference to the recipient. To be shown to the user during authorization with their issuer. | ||||||

Merchant Object | ||||||

| productId | String | Max length: 35 | Required | |||

| Product identification assigned by PayNet during merchant registration in Developer Portal. | ||||||

End Merchant Object | ||||||

Customer Object | ||||||

| name | String | Max length: 140 | Required | |||

| Name of payer by initiating acquirer. | ||||||

| identityValidation | String | Max length: 2 | Required | |||

| Indicates if Debiting Bank should perform validation on payer information. 00 - No Validation 01 - Debtor Name Check 02 - Debtor Identification Check (NRIC, Passport or etc) 03 - Debtor Name and Identification Check | ||||||

| identificationType | String | Max length: 2 | Optional | |||

| When this field is sent, Debiting Bank to ensure the identification field match with their internal record before allowing to debit from the account. 01 - New IC Number The Identification Type used is IC Number. 02 - Army Number The Identification Type used is Army Number. 03 - Passport Number The Identification Type used is Passport Number. 04 - Registration Number The Identification Type used is Registration Number. 05 - Mobile Number The Identification Type used is Mobile Phone. | ||||||

| identification | String | Max length: 140 | Conditional | |||

| This field is mandatory if identificationType above present. The value will based on the identificationType selected above. New IC Number - without hyphens. Eg: 840312145594 Army Number - only numbers. Eg: 20248 Passport Number - Include country of issuance. Eg: E394029340VSGP Registration Number - alphanumeric. Eg: JM1234567-Z Mobile Number - include country or area code with full mobile number. Eg: +60103772812 | ||||||

End Customer Object | ||||||

| language | String | Max length: 2 | Required | |||

| Select the preferred language to redirect into DuitNow Pay: en - English bm - Bahasa Malaysia | ||||||

Sample Request:

{

"dataType": "01",

"transactionFlow": "01",

"checkoutId": "a7e2ed2a-b088-4495-8cf4-88da08f644f2",

"sourceOfFunds": [

"01"

],

"amount": "10.00",

"merchantName": "Shop Name Sdn Bhd.",

"merchantReferenceId": "ref12345678",

"merchant": {

"productId": "P00000201"

},

"customer": {

"name": "Walter Mitty",

"identityValidation": "00",

"identificationType": "05",

"identification": "+60123456789"

},

"language": "en"

}

Response

Data Object | ||||||

| id | String | Max length: 100 | Required | |||

| Session ID that is created by PayNet for the redirect URL. | ||||||

| redirectUrl | String | Max length: 140 | Required | |||

| Acquirer can use the redirect URL to open the page directly which will land on DuitNow Pay or Save Payment Method Webview depending on the dataType submitted in the request. | ||||||

End Data Object | ||||||

| message | String | Max length: 1024 | Required | |||

| Response with "OK" if successful. Otherwise, please refer to the reason codes in the appendix. | ||||||

Sample Response:

{

"data": {

"id": "4950369a-5ad4-403f-8d8a-675990011b56",

"redirectUrl":"https://duitnow-pay.uat.inet.paynet.my:8443/?sessionId=4950369a-5ad4-403f-8d8a-675990011b56"

},

"message": "OK"

}

Webhook: Update Checkout Details

This webhook maps the endToEndId to the checkoutId. This allows the acquirer to relate the endToEndId in the redirect URL back to the checkoutId when the issuer redirects with only the endToEndId in Step 19.

Request

Webhook endpoint will be provided by acquirer during onboarding.

| checkoutId | String | Max length: 36 | Required | |||

| The unique external identifier (uuid v4) provided by the acquirer to PayNet when initiating a payment intent. | ||||||

| rtpEndToEndId | String | Max length: 35 | Required | |||

| Unique message identification from RPP. This can be used to reconcile with RPP BackOffice or Reports. | ||||||

| issuer | String | Max length: 100 | Required | |||

| Name of payer’s issuing bank / wallet. | ||||||

| paymentMethod | String | Max length: 2 | Required | |||

| Payer selected payment method: 01 - DuitNow Online Banking / Wallets | ||||||

Sample Request:

{

"checkoutId": "a7e2ed2a-b088-4495-8cf4-88da08f644f2",

"rtpEndToEndId": "20240325M0000201861OBW00618197",

"issuer": "Affin Bank",

"paymentMethod": "01"

}

Webhook: Update Payment Status

This webhook is to update the acquirer on the status and details of a successful transaction. It will only trigger if the transfer is successful for checkout via WebView.

For corporate flows that have triggered (transactionFlow = “02”), please perform an Enquire Payment Status on the 5th day to confirm the final status of the transaction.

If acquirer does not receive this webhook, kindly perform Retrieve Payment Status API to enquire the status of transaction.

Request

Webhook endpoint will be provided by acquirer during onboarding.

| checkoutId | String | Max length: 36 | Required | |||

| The unique external identifier (uuid v4) provided by the acquirer to PayNet when initiating a payment intent. | ||||||

| endToEndId | String | Max length: 35 | Required | |||

| Unique message identification from RPP. This can be used to reconcile with RPP BackOffice or Reports. | ||||||

PaymentStatus Object | ||||||

| payerName | String | Max length: 100 | Required | |||

| Name of payer from the debiting bank. | ||||||

| code | String | Max length: 4 | Required | |||

| Please refer to the list of status codes. | ||||||

| substate | String | Max length: 35 | Required | |||

| substate: RECEIVED – Pending CLEARED – Successful Credit REJECTED – Rejection from Debiting Agent PENDAUTH – Pending authorization from Debiting Agent | ||||||

| message | String | Max length: 1024 | Required | |||

| Please refer to the list of reason codes. | ||||||

End PaymentStatus Object | ||||||

| issuer | String | Max length: 100 | Required | |||

| Name of payer’s issuing bank / wallet. | ||||||

| paymentMethod | String | Max length: 2 | Required | |||

| Payer selected payment method: 01 - DuitNow Online Banking / Wallets | ||||||

Sample Request:

{

"checkoutId": "a7e2ed2a-b088-4495-8cf4-88da08f644f2",

"endToEndId": "20240119M0000201861OBW00000004",

"paymentStatus": {

"payerName": "DMMMYKL3 Test",

"code": "ACTC",

"substate": "PENDAUTH",

"message": "U002"

},

"issuer": "Affin Bank",

"paymentMethod": "01"

}

Once the authorizer approved the payment request and the corporate issuing bank. It will then responded with another webhook of “Update Payment Status” and the substate shall be responding as “CLEARED”.

Sample Request:

{

"checkoutId": "a7e2ed2a-b088-4495-8cf4-88da08f644f2",

"endToEndId": "20240119M0000201861OBW00000004",

"paymentStatus": {

"payerName": "DMMMYKL3 Test",

"code": "ACTC",

"substate": "CLEARED",

"message": "U002"

},

"issuer": "Affin Bank",

"paymentMethod": "01"

}

Webhook: Update Payment Status (rejected)

This webhook is to update the acquirer if there is rejection during the authorization of a transaction. If the transaction successful, this webhook will not be triggered.

Request

Webhook endpoint will be provided by acquirer during onboarding.

| checkoutId | String | Max length: 36 | Required | |||

| The unique external identifier (uuid v4) provided by the acquirer to PayNet when initiating a payment intent. | ||||||

| endToEndId | String | Max length: 35 | Required | |||

| Unique message identification from RPP. This can be used to reconcile with RPP BackOffice or Reports. | ||||||

PaymentStatus Object | ||||||

| code | String | Max length: 4 | Required | |||

| Please refer to the list of status codes. | ||||||

| substate | String | Max length: 35 | Required | |||

| substate: RECEIVED – Pending CLEARED – Successful Credit REJECTED – Rejection from Debiting Agent PENDAUTH – Pending authorization from Debiting Agent | ||||||

| message | String | Max length: 1024 | Required | |||

| Please refer to the list of reason codes. | ||||||

End PaymentStatus Object | ||||||

| issuer | String | Max length: 100 | Required | |||

| Name of payer’s issuing bank / wallet. | ||||||

| paymentMethod | String | Max length: 2 | Required | |||

| Payer selected payment method: 01 - DuitNow Online Banking / Wallets | ||||||

Sample Request:

{

"checkoutId": "a7e2ed2a-b088-4495-8cf4-88da08f644f2",

"endToEndId": "20240119M0000201861OBW00000004",

"paymentStatus": {

"code": "ACSP",

"substate": "REJECTED",

"message": "U000"

},

"issuer": "Affin Bank",

"paymentMethod": "01"

}

Guidance to Perform Payment Enquiry

Scenario example:

If there is missing update checkout details from the webhook, but the debiting agent is redirected and receives the update payment status from webhook, no further enquiry is needed, and the payment is confirmed as successful.

Please refer the table below to understand which suitable action that you may need to perform:

| Webhook: Update Checkout Details | Debiting Agent Redirected | Webhook: Update Payment Status | Action |

|---|---|---|---|

❌ | ✅ | ✅ | No enquiry required, payment successful. |

✅ | ✅ | ❌ | Perform Enquire Payment Status. |

❌ | ✅ | ❌ | Perform Enquire Checkout Details. If it successful responded, please proceed to perform Enquire Payment Status. |

❌ | ❌ | ❌ |