National Addressing Database (NAD)

See also API reference for NAD

The National Addressing Database (NAD) allows customers to register and link their accounts to a proxy of their choosing. Fundamentally, a unique proxy may be registered and linked to one account which is a one-to-one relationship. However, an account can be linked to multiple proxies which is a one-to-many relationship. These proxy rules apply even when the customer has accounts with multiple Participants.

Below table summarized the customer and proxy relationship

| Same Customer (Secondary Id) | Same Participant | Same Account | Same Proxy Type | Same Proxy Id | NAD Service Type | Description |

|---|---|---|---|---|---|---|

| No | No | No | No | No | New | New Registration |

| Yes | No | No | No | No | New | New Registration of a proxy at a different Participant (same customer) |

| Yes | Yes | No | No | No | New | New Registration of another account and another proxy from the same customer |

| Yes | Yes | Yes | No | No | New | Register another proxy for the same account |

| Yes | Yes | No | No | No | New | Register a new proxy for the account |

| No | No | No | Yes | Yes | Not allowed | Proxy linked to another account in another participant for another customer so transfer bank is not allowed |

| Yes | No | No | Yes | Yes | Transfer Bank | Proxy linked to another account in another participant for same customer, transfer bank is allowed |

| Yes | Yes | No | Yes | Yes | Modify Account | Proxy linked to another account within the same participant. Option to transfer proxy to current account |

| Yes | Yes | Yes | Yes | Yes | Deregister, Suspend or Activate |

|

Proxy Identifiers

Over the past years, proxy identifiers have become an integral part especially in countries adopting real-time payment and it is expected to become widespread across the payments landscape.

What is a Secondary Identifier or Proxy?

Historically, most countries rely on the Bank Account Number as the unique identifier for payment instructions exchanged between banks. In the context of international payment, this field is also known as IBAN (International Bank Account Number). Account number is a customer’s unique primary account identifier in linking the relationship between the financial institution and customer

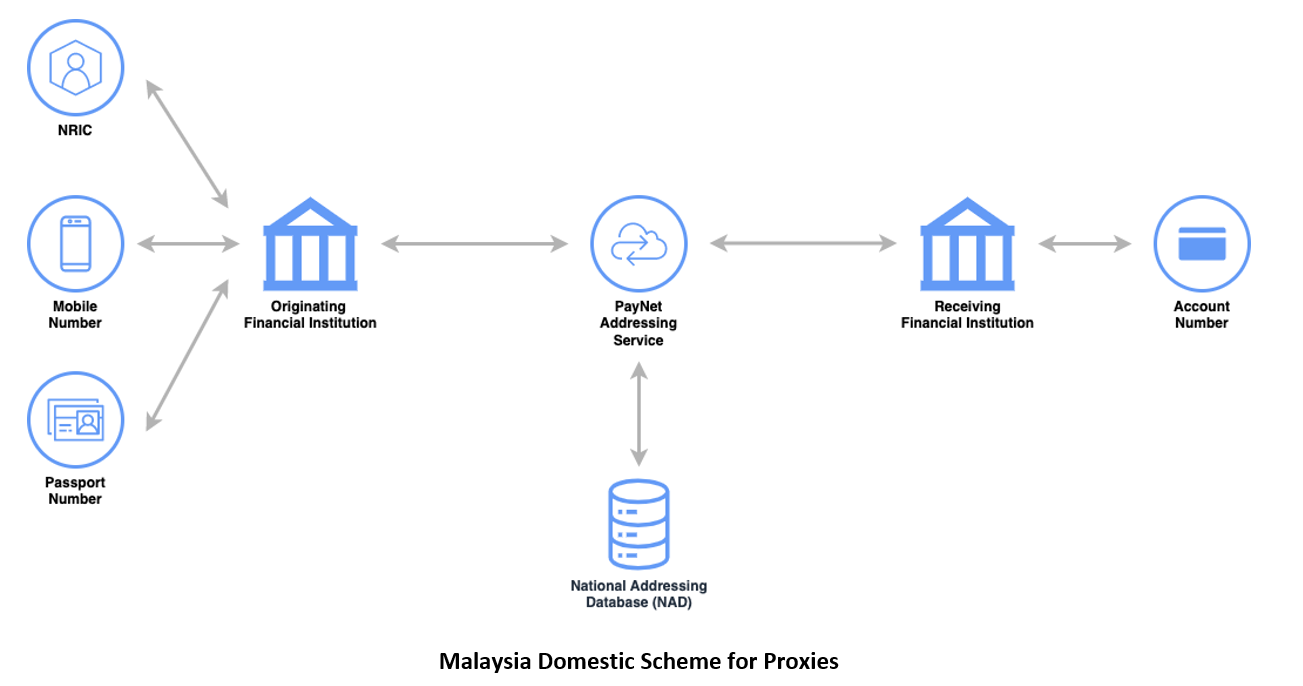

A proxy or secondary identifier allows customers to perform payments by identifying beneficiary using a non-account number identifier such as mobile phone number, NRIC, passport number and etc

These secondary identifiers are linked to primary identifiers so that originators can address payments to beneficiaries by instructing proxy identifiers instead of account number.

Main Drivers for the Introduction and Adoption of Secondary Identifiers

With secondary identifiers beneficiaries can receive payments without sharing bank account details with originators. By providing less sensitive information, beneficiaries’ privacy concerns get addressed while friction is removed from their payment experience. Entering a phone number for example, is less error-prone and more convenient than typing an account number in a payment instruction. This simplification of the customer experience in the exchange of money will be the key to ensure a rapid adoption of secondary identifiers. The value derived from these new proxy services will of course depend on the number of registered participants and business cases are being built upon fee-based models for the schemes.

Proxy Types of Malaysia Domestic Scheme

- Mobile Phone Number (only local number is supported)

- National Registration Identity Card (NRIC)

- Passport Number

- Army or Police Number

- Business Registration Number

Proxy Services of the Malaysia Domestic Scheme

- Register – allow associating an account number to one or several proxy identifiers

- Enquiry – return all proxy identifiers linked to a particular account number

- Look-up – return the matching account number for a given proxy identifier

- Deregister – remove the link between an account number and a proxy identifier

- Transfer Bank – allow transfer of a proxy to another Participant